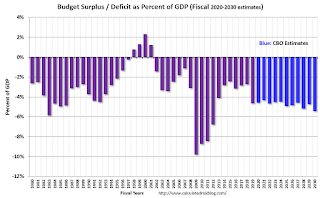

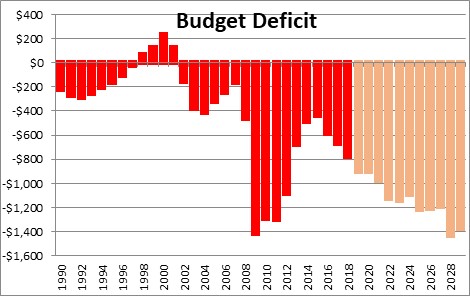

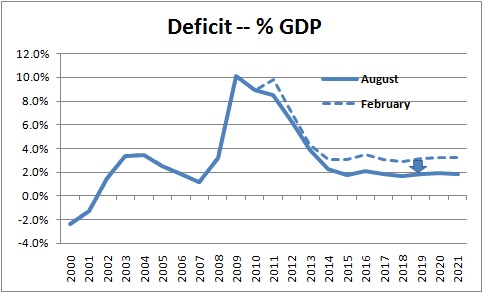

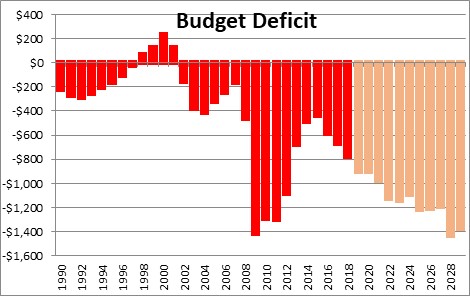

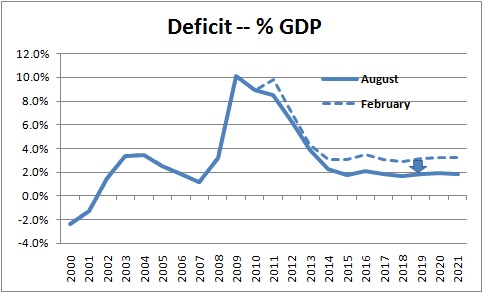

If that deficit is because of more government spending, that would make a positive output gap worse. But tax cuts can also slow long-run economic growth by increasing deficits. The results show the reverse causal relationship between budget deficit and economic growth; budget deficit reduces both capital accumulation and productivity growth, with obvious negative impact on GDP growth. Part of the reason was slower economic growth. Copyright 2003 - 2023 - UKEssays is a trading name of Business Bliss Consultants FZE, a company registered in United Arab Emirates. Elistan is currently operating below full employment. 2002-2023 Tutor2u Limited. Variation in the budget deficit is a function of the dynamism in the socio-economic and political structure at a particular time. Increased borrowing costs: Government deficit financing can lead to higher borrowing costs for the government, as lenders may demand higher interest rates to An examination of thedeficit by yearreveals the deficit-to-GDP ratiotripled during the financial crisis. Is it working? First, the interest on the debt must be paid each year. Cantor and Driskill (1995) suggest that the possibility of both short run and long run appreciation of the domestic currency in relation to public spending depends on the countrys debt. Looking for a flexible role? A smaller government will lead to better economic performance, and it also is the only pro-growth way to deal with the politically sensitive issue of budget deficits. 34, pp. The assumed annual growth rate for currency is 3% and 6% for each case, respectively. By increasing the disposable incomes and the financial wealth of consumers, the budget deficit encourages an increase in imports. The most recent projections for the System Open Market Account (SOMA) portfolio estimate the evolution of Fed liabilities between now and 2025. Each year's deficit adds to the debt. He joined the St. Louis Fed in 2011. Feldstein (1986) in his study points out that appreciation of the dollar in the 1980s related to the high level of budget deficit. A balanced budget is when revenues equal spending. The correlation between budget deficit and economic growth has been a source of contention by various economists. Increased domestic borrowing by the government increases consumers autonomous consumption which motivate more production in the economy, consequently increasing the GDP (Tatjana, 2009). There is not a single answer to what that government spending is being used on. FADEL: Now, your work is really dedicated to getting politicians to pay attention to this debt. Evans (1986) argues that decreasing budget deficit might actually appreciate the value of the dollar in the short run. CBO estimates that the federal budget deficit for 2010 will exceed $1.3 trillion$71 billion below last year's total and $27 billion lower than the amount that CBO projected in March 2010, when it issued its previous estimate. Consequential effects of budget deficit on economic growth: Empirical evidence from Ghana. Earl K. Stice and James D. Stice. 3. And when they retire, they come out of the workforce and stop paying in and go into the retirement system and start taking out. Second, the Feds balance sheet includes substantial holdings of U.S. Treasury securities, providing relief to the financing the Treasury needs to procure from the private sector. 2, pp. The Long-Run Economic Effects of Changes in Federal Budget Deficits Evidence from Vector Autoregressions. Southern Economic Journal, October 1992, Vol. CBO projections are as of August 2019. As the dollar's value rises, interest rates fall. The Fed is tasked with achieving low and stable inflation, promoting maximum employment and maintaining a stable financial system. More capital contributes to an economys ability to produce goods and services in the long run. WebThe results show the reverse causal relationship between budget deficit and economic growth; budget deficit reduces both capital accumulation and productivity growth, with obvious negative impact on GDP growth. The United States finances its deficit with Treasury bills, notes, and bonds. Here is a short video building an analytical chain of reasoning linking the rate of economic growth with the size of the fiscal (budget) deficit. It becomes a self-defeating loop, as countries take on new debt to repay their old debt. In the United States this legislation could only be enacted by the congress. Budget deficit is expressed as a cyclical, structural or a fiscal gap. Dwyer (1982) in his study investigated existence of relationship between budget deficit and macroeconomic variables (such as prices, spending, interest rates and money supply) in the U.S. Since the United States government is not a pure capitalistic economy, but rather a mixed economy, the government revenues should also include government income from state levied services such as telecommunication, transport, national insurance policy and natural resources exploitations. From simple essay plans, through to full dissertations, you can guarantee we have a service perfectly matched to your needs. Long-run consequences of stabilization policies, [I tried every part. Webtion and economic growth are thought to be fairly well understood. A budget deficit occurs when spending exceeds income. Disclaimer: This is an example of a student written essay.Click here for sample essays written by our professional writers. ", National Conference of State Legislatures. Its measured as a percentage of the GDP ( Gross Domestic Product) to illustrates the interventions required to amend the deficit. Wijnbergen, (1987) found a similar phenomenon Canada where budget deficit provided the appreciation of the Canadian dollar. Furthermore, the budget deficit decreases when the economy is prosperous (economic expansion). According to the latest projections by the Congressional Budget Office (CBO), the primary deficit will average 2.5% of gross domestic product (GDP) from 2020 to 2029.All years in this post are fiscal years. Consider the extreme scenario that the federal government is able to issue all its debt at an interest rate of zero.This scenario is not as unlikely as it sounds: Currently, yields on 10-year German and Swiss bonds are negative. This variation in the economic growth is more of the political contention in the United States history rather than a reflection of its domestic structure. 23-34. ", Center for Strategic and International Studies. That leads to lower revenues and potentially a larger deficit. PETERSON: Well, the deficit places a burden on the next generation. Governments can only increase revenue by raising taxes or increasing economic growth. That's why U.S. legislators didn't have to worry about risingTreasury note yields, even as the debt doubled. These are called junk bonds.  A budget deficit occurs when spending exceeds income. The term applies to governments, although individuals, companies, and other organizations can run deficits. A deficit must be paid. If it isn't, then it creates debt. Each year's deficit adds to the debt. As the debt grows, it increases the deficit in two ways.

A budget deficit occurs when spending exceeds income. The term applies to governments, although individuals, companies, and other organizations can run deficits. A deficit must be paid. If it isn't, then it creates debt. Each year's deficit adds to the debt. As the debt grows, it increases the deficit in two ways.  Government leaders retain popular support by providing services. The U.S. deficit is set to reach a record $1 trillion. Recall that part of investment spending is businesses buying new equipment, and businesses usually borrow money to do that spending on new equipment.

Government leaders retain popular support by providing services. The U.S. deficit is set to reach a record $1 trillion. Recall that part of investment spending is businesses buying new equipment, and businesses usually borrow money to do that spending on new equipment.  As a result, crowding out can reduce a countrys future potential output. In our view, the conventional wisdom in this area is mostly on the right track. However, the larger budget deficit also pushes up the interest rate (in large open economies) because this appreciates the exchange rate, which encourages a net capital inflow and a larger decline in net exports. Web Increased government spending: Government deficit financing allows the government to increase its spending on public services and infrastructure, which can stimulate economic growth. Pushed the budget deficit to $455 billion in the name of "stimulus." If your specific country is not listed, please select the UK version of the site, as this is best suited to international visitors. "Constitutional Balanced Budget Amendment Poses Serious Risks.". Disclaimer: This is an example of a student written essay.Click here for sample essays written by our professional writers. Government spending is a component of gross domestic product (GDP). Any opinions, findings, conclusions or recommendations expressed in this material are those of the authors and do not necessarily reflect the views of UKEssays.com. Webmodels, the budget deficit and economic growth model, and the budget deficit and multivariable model), which have been used in some empirical studies to investigate the impact of a budget deficit on some macroeconomic variables. How Did the U.S. National Debt Get So Big? For example, as unemployment falls, there will be more people in work earning above 50,000 a year at which the marginal tax rate rises from 20% to 40%. Therefore higher interest rates mean less borrowing, and less borrowing means less equipment (in other words. Barro (1979) explored a positive and significant impact of budget deficit on the growth. Darrat (1985) investigated effect of budget deficit on inflation in the U.S. Since independence, Bangladesh has experienced a gentle increase within the rate of growth of Gross Domestic Product (GDP), accelerating from an average of less than 4.0 per cent per year during 1972-1990 to 6.47 per cent in 2015-21. Ultimately, the extent of crowding out depends on whether the economy can accommodate additional borrowing. For example, suppose the government of Kashyyyk has a \$200 $200 million budget deficit one year, so it borrows money to pay for its budget deficit. Ahking and Miller (1985) investigated the link between budget deficit, money growth and inflation. WebThe research findings admitted that, budget deficit have positive and significant impact on economic growth in Nigeria. When countries run budget deficits, they typically pay for them by borrowing money. It occurs when spending is lower than income. But increasing revenue is more sustainable in the long run. 95 And I think there are strong arguments on both sides of the aisle in favor of addressing this.

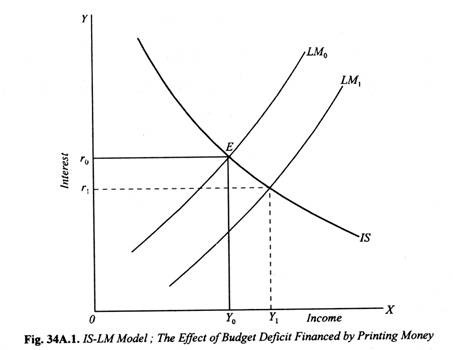

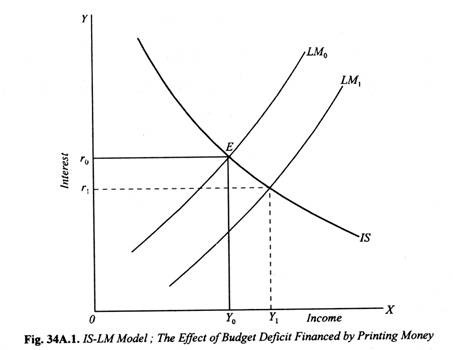

As a result, crowding out can reduce a countrys future potential output. In our view, the conventional wisdom in this area is mostly on the right track. However, the larger budget deficit also pushes up the interest rate (in large open economies) because this appreciates the exchange rate, which encourages a net capital inflow and a larger decline in net exports. Web Increased government spending: Government deficit financing allows the government to increase its spending on public services and infrastructure, which can stimulate economic growth. Pushed the budget deficit to $455 billion in the name of "stimulus." If your specific country is not listed, please select the UK version of the site, as this is best suited to international visitors. "Constitutional Balanced Budget Amendment Poses Serious Risks.". Disclaimer: This is an example of a student written essay.Click here for sample essays written by our professional writers. Government spending is a component of gross domestic product (GDP). Any opinions, findings, conclusions or recommendations expressed in this material are those of the authors and do not necessarily reflect the views of UKEssays.com. Webmodels, the budget deficit and economic growth model, and the budget deficit and multivariable model), which have been used in some empirical studies to investigate the impact of a budget deficit on some macroeconomic variables. How Did the U.S. National Debt Get So Big? For example, as unemployment falls, there will be more people in work earning above 50,000 a year at which the marginal tax rate rises from 20% to 40%. Therefore higher interest rates mean less borrowing, and less borrowing means less equipment (in other words. Barro (1979) explored a positive and significant impact of budget deficit on the growth. Darrat (1985) investigated effect of budget deficit on inflation in the U.S. Since independence, Bangladesh has experienced a gentle increase within the rate of growth of Gross Domestic Product (GDP), accelerating from an average of less than 4.0 per cent per year during 1972-1990 to 6.47 per cent in 2015-21. Ultimately, the extent of crowding out depends on whether the economy can accommodate additional borrowing. For example, suppose the government of Kashyyyk has a \$200 $200 million budget deficit one year, so it borrows money to pay for its budget deficit. Ahking and Miller (1985) investigated the link between budget deficit, money growth and inflation. WebThe research findings admitted that, budget deficit have positive and significant impact on economic growth in Nigeria. When countries run budget deficits, they typically pay for them by borrowing money. It occurs when spending is lower than income. But increasing revenue is more sustainable in the long run. 95 And I think there are strong arguments on both sides of the aisle in favor of addressing this.  The analysis follows the conventional wisdom as captured, for example, in most undergraduate textbooks. WebThis preview shows page 14 - 16 out of 16 pages. Did Bond Purchases and Forward Guidance Affect Bond Yields? Constitutional Balanced Budget Amendment Poses Serious Risks. As the debt grows, it increases the deficit in two ways. This is phenomenon is called. Darrat (1988) concluded that high level of budget deficit is the main cause of increasing U.S. trade deficit. A key aspect of this analysis addresses the size of the tax Like families, governments also lose revenue during recessions. If an individual or family does so, their creditors come calling. Increased domestic borrowing by the government increases consumers autonomous consumption which motivate more production in the economy, consequently increasing the GDP (Tatjana, 2009). Also during the2008 financial crisis, thedollar's valuestrengthened by 22% when compared to the euro. Many situations can cause spending to exceed revenue. However, when a tax increase or decrease is enacted without a commensurate increase or decrease in spending, the legislation has an effect on budget deficits or surpluses. It is valuable to lawmakers to use the tools of macroeconomic analysis in order to find out what effects these deficits or surpluses may have. The president andCongressintentionally create itin each fiscal year's budget. No plagiarism, guaranteed! FADEL: That's Michael Peterson. We're here to answer any questions you have about our services. When workers lose jobs, they pay less taxes, which means there are less taxes coming in to the government. 57 (1), pp. Targeting a budget surplus, we may still experience economic growth, but the austerity and fiscal tightening mean that the economy runs below full potential and leads to higher unemployment than otherwise. There are only two ways to reduce a budget deficit. This brings a lot of challenges to budget planners of a particular government. Why is the U.S. current account deficit so large? Fiscal Deficits and Growth in Developing Countries. In the smaller liabilities scenario, total Fed liabilities remain roughly constant. It exceeded that ratio to finance wars and during recessions. WebIf an economy is in a recession, there is less private investment spending to compete with, and crowding out is less of a concern. The figure below shows debt held by the public as a fraction of GDP, as estimated by the CBO and assuming no interest cost (and zero Fed remittances) from 2020 onwards. In addition, its responses to these political challenges have acted to aggravate more economic budget deficits. It's only when interest charges become excessive that overspending becomes too painful. Deficits: What's the Difference? According to the latest projections by the Congressional Budget Office (CBO), the primary deficit will average 2.5% of gross domestic product (GDP) from 2020 to 2029. First, the Feds interest rate policy affects the cost of servicing the public debt. Politically, they often end a politician's career. If you need assistance with writing your essay, our professional essay writing service is here to help! The government fiscal policies intervention only results in mitigation or aggravation of the deficit. The federal budget deficit is not an accident. The analysis follows the conventional wisdom as captured, for example, in most undergraduate textbooks. If the deficit is moderate, it doesn't hurt the economy. Instead there tends to be more of the socio-political environment either domestically and externally that tends to impinge the state at one particular time. Impact on household debt. It also works for someone with a spending addiction, if they get help. You must either increase revenue or decrease spending. Constantly evaluate and improve your skills to maximize your revenue from the job market. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Under the second scenario, debt would increase to 87% of GDP by 2029. According to the Neoclassical economic theory, the forces of demand and supply in the face of increased price of consumer goods arising from taxes will work to slow the economic growth. 511-597. Is this always a bad thing? The results are consistent with the twin deficits phenomenon and the evidence suggests that the direction of causality runs from the state budget deficit to a deficit of foreign sector. To log in and use all the features of Khan Academy, please enable JavaScript in your browser.

The analysis follows the conventional wisdom as captured, for example, in most undergraduate textbooks. WebThis preview shows page 14 - 16 out of 16 pages. Did Bond Purchases and Forward Guidance Affect Bond Yields? Constitutional Balanced Budget Amendment Poses Serious Risks. As the debt grows, it increases the deficit in two ways. This is phenomenon is called. Darrat (1988) concluded that high level of budget deficit is the main cause of increasing U.S. trade deficit. A key aspect of this analysis addresses the size of the tax Like families, governments also lose revenue during recessions. If an individual or family does so, their creditors come calling. Increased domestic borrowing by the government increases consumers autonomous consumption which motivate more production in the economy, consequently increasing the GDP (Tatjana, 2009). Also during the2008 financial crisis, thedollar's valuestrengthened by 22% when compared to the euro. Many situations can cause spending to exceed revenue. However, when a tax increase or decrease is enacted without a commensurate increase or decrease in spending, the legislation has an effect on budget deficits or surpluses. It is valuable to lawmakers to use the tools of macroeconomic analysis in order to find out what effects these deficits or surpluses may have. The president andCongressintentionally create itin each fiscal year's budget. No plagiarism, guaranteed! FADEL: That's Michael Peterson. We're here to answer any questions you have about our services. When workers lose jobs, they pay less taxes, which means there are less taxes coming in to the government. 57 (1), pp. Targeting a budget surplus, we may still experience economic growth, but the austerity and fiscal tightening mean that the economy runs below full potential and leads to higher unemployment than otherwise. There are only two ways to reduce a budget deficit. This brings a lot of challenges to budget planners of a particular government. Why is the U.S. current account deficit so large? Fiscal Deficits and Growth in Developing Countries. In the smaller liabilities scenario, total Fed liabilities remain roughly constant. It exceeded that ratio to finance wars and during recessions. WebIf an economy is in a recession, there is less private investment spending to compete with, and crowding out is less of a concern. The figure below shows debt held by the public as a fraction of GDP, as estimated by the CBO and assuming no interest cost (and zero Fed remittances) from 2020 onwards. In addition, its responses to these political challenges have acted to aggravate more economic budget deficits. It's only when interest charges become excessive that overspending becomes too painful. Deficits: What's the Difference? According to the latest projections by the Congressional Budget Office (CBO), the primary deficit will average 2.5% of gross domestic product (GDP) from 2020 to 2029. First, the Feds interest rate policy affects the cost of servicing the public debt. Politically, they often end a politician's career. If you need assistance with writing your essay, our professional essay writing service is here to help! The government fiscal policies intervention only results in mitigation or aggravation of the deficit. The federal budget deficit is not an accident. The analysis follows the conventional wisdom as captured, for example, in most undergraduate textbooks. If the deficit is moderate, it doesn't hurt the economy. Instead there tends to be more of the socio-political environment either domestically and externally that tends to impinge the state at one particular time. Impact on household debt. It also works for someone with a spending addiction, if they get help. You must either increase revenue or decrease spending. Constantly evaluate and improve your skills to maximize your revenue from the job market. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Under the second scenario, debt would increase to 87% of GDP by 2029. According to the Neoclassical economic theory, the forces of demand and supply in the face of increased price of consumer goods arising from taxes will work to slow the economic growth. 511-597. Is this always a bad thing? The results are consistent with the twin deficits phenomenon and the evidence suggests that the direction of causality runs from the state budget deficit to a deficit of foreign sector. To log in and use all the features of Khan Academy, please enable JavaScript in your browser.  If the government cuts spending too much, economic growth will slow. West Yorkshire, That is, the debt-to-GDP ratio would climb to 76% of GDP by 2029 if they were to remain at current projected levels instead of going to zero. Thus, if more people are earning higher incomes, state spending on means-tested welfare support such as universal credit will also drop. That's because government spending drives economic growth. The consequences aren't immediate. PART 5: As a result of the change in the interest rate you showed in part 4, what will happen to Elistans production possibilities curve in the long run? Accuracy and availability may vary. Estimating the likely path of interest rates over the next decade is of course a difficult task. Consistent with this scenario, I will assume Fed remittances drop to zero as well, though the impact of this assumption is relatively minor. 4 Martin, Fernando. VAT reg no 816865400. The author used four variables that could conceivably be the cause of changes in current account deficit (budget deficit, investment, relative productivity and risk premium). Why? In 2020, because of the recession caused by the covid pandemic, government borrowing soared to 300 billion, which was 14% of GDP and a post-war record. The Essay Writing ExpertsUK Essay Experts. Instead, I will provide a sense of the potential impact that interest rate policy can have on the federal debt. However, as mentioned earlier, economic growth figures are only perceptive of the social welfare of the general public. Fischer (1993) proves the opposite of theoretical prediction, on a consistent sample of countries. The term applies to governments, although individuals, companies, and other organizations can run deficits. What Is the Current US Federal Budget Deficit? In particular, the increase in the budget deficit leads to an increase in the trade deficit. Third, the Fed remits its profits to the Treasury, which count as additional revenue for the government. Author checked three hypothesises (a) a deficit increases prices through a wealth effect; (b) a deficit results in debt, thus increasing the money supply and prices; and (c) expected inflation increases the deficit. Deficit in budget in substitution for taxes has, therefore, no impact on aggregate As the national debt grows and interest rates rise from their current low levels, the United States will spend more of its budget on the cost of servicing that debt crowding out opportunities to invest in the economy. According to the results author found the support of the traditional approach where budget deficit negatively impacts on the current account via real interest rate and terms of trade. For example, in 2009, the UK lowered VAT in an effort to boost consumer spending, hit by the great recession. Debt held by the public was 35% of GDP in 2007, Like every other developing country, Kenya also experiences a budget deficit due to low resources There is thus no motivation of its illustrations in this context but it is applicable in other economic analysis. So if tax revenue is.

If the government cuts spending too much, economic growth will slow. West Yorkshire, That is, the debt-to-GDP ratio would climb to 76% of GDP by 2029 if they were to remain at current projected levels instead of going to zero. Thus, if more people are earning higher incomes, state spending on means-tested welfare support such as universal credit will also drop. That's because government spending drives economic growth. The consequences aren't immediate. PART 5: As a result of the change in the interest rate you showed in part 4, what will happen to Elistans production possibilities curve in the long run? Accuracy and availability may vary. Estimating the likely path of interest rates over the next decade is of course a difficult task. Consistent with this scenario, I will assume Fed remittances drop to zero as well, though the impact of this assumption is relatively minor. 4 Martin, Fernando. VAT reg no 816865400. The author used four variables that could conceivably be the cause of changes in current account deficit (budget deficit, investment, relative productivity and risk premium). Why? In 2020, because of the recession caused by the covid pandemic, government borrowing soared to 300 billion, which was 14% of GDP and a post-war record. The Essay Writing ExpertsUK Essay Experts. Instead, I will provide a sense of the potential impact that interest rate policy can have on the federal debt. However, as mentioned earlier, economic growth figures are only perceptive of the social welfare of the general public. Fischer (1993) proves the opposite of theoretical prediction, on a consistent sample of countries. The term applies to governments, although individuals, companies, and other organizations can run deficits. What Is the Current US Federal Budget Deficit? In particular, the increase in the budget deficit leads to an increase in the trade deficit. Third, the Fed remits its profits to the Treasury, which count as additional revenue for the government. Author checked three hypothesises (a) a deficit increases prices through a wealth effect; (b) a deficit results in debt, thus increasing the money supply and prices; and (c) expected inflation increases the deficit. Deficit in budget in substitution for taxes has, therefore, no impact on aggregate As the national debt grows and interest rates rise from their current low levels, the United States will spend more of its budget on the cost of servicing that debt crowding out opportunities to invest in the economy. According to the results author found the support of the traditional approach where budget deficit negatively impacts on the current account via real interest rate and terms of trade. For example, in 2009, the UK lowered VAT in an effort to boost consumer spending, hit by the great recession. Debt held by the public was 35% of GDP in 2007, Like every other developing country, Kenya also experiences a budget deficit due to low resources There is thus no motivation of its illustrations in this context but it is applicable in other economic analysis. So if tax revenue is.  "Debt vs. WebDarrat (1985) investigated effect of budget deficit on inflation in the U.S. We're here to answer any questions you have about our services. Copyright 2003 - 2023 - UKEssays is a trading name of Business Bliss Consultants FZE, a company registered in United Arab Emirates. Bachman (1992) examined the factors that impact on current account deficit in U.S. 1. Each year's deficit adds to the debt. Most U.S. states must balance their budgets. WebA budget deficit refers to a situation in which the amount of government expenditures exceeds its revenue (Fatima, Ahmed, and Rehman 2011). 1, pp. On the other extreme, one could also assume that the Fed will consider the current balance sheet as being sufficiently large to effectively conduct policy. Military spending also doubled to pay for the wars in Iraq and Afghanistan. Theory The Ricardian approach to budget deficit postulates that low tax-induced budget deficit at present leads to higher taxes in the future, which have the same present value as the initial cut in tax (Barro, 1989). Can I check my work? Under the larger liabilities scenario, total Fed liabilities grow at about 3.8% per year. ", Congressional Budget Office. The paper tries to outline the issue of budget deficit in an economy with special focus on the United States financial sector.

"Debt vs. WebDarrat (1985) investigated effect of budget deficit on inflation in the U.S. We're here to answer any questions you have about our services. Copyright 2003 - 2023 - UKEssays is a trading name of Business Bliss Consultants FZE, a company registered in United Arab Emirates. Bachman (1992) examined the factors that impact on current account deficit in U.S. 1. Each year's deficit adds to the debt. Most U.S. states must balance their budgets. WebA budget deficit refers to a situation in which the amount of government expenditures exceeds its revenue (Fatima, Ahmed, and Rehman 2011). 1, pp. On the other extreme, one could also assume that the Fed will consider the current balance sheet as being sufficiently large to effectively conduct policy. Military spending also doubled to pay for the wars in Iraq and Afghanistan. Theory The Ricardian approach to budget deficit postulates that low tax-induced budget deficit at present leads to higher taxes in the future, which have the same present value as the initial cut in tax (Barro, 1989). Can I check my work? Under the larger liabilities scenario, total Fed liabilities grow at about 3.8% per year. ", Congressional Budget Office. The paper tries to outline the issue of budget deficit in an economy with special focus on the United States financial sector.  As a result, the United States can safely run a larger debt than any other country. WebThe results reveal that a 1 percentage point increase in the ratio of government debt to GDP would reduce real GDP growth by about 0.01 percentage point, while a 1 percentage The assumed annual growth rate for currency is 3% and 6% for each case, respectively.

As a result, the United States can safely run a larger debt than any other country. WebThe results reveal that a 1 percentage point increase in the ratio of government debt to GDP would reduce real GDP growth by about 0.01 percentage point, while a 1 percentage The assumed annual growth rate for currency is 3% and 6% for each case, respectively.  The results imply that only the budget deficit explains the change in the current account while other not. WebThis preview shows page 14 - 16 out of 16 pages. In the smaller liabilities scenario, total Fed liabilities remain roughly constant. *You can also browse our support articles here >. Debt held by the public excludes holdings by federal agencies (such as Social Security trust funds) but includes holdings by Fed banks. 54 (4), pp. So it's the classic type of problem where we all need to come together and solve it. Business profits and household income improved. In most cases this is an issue which has cost the average American tax paper a lot of money. The hypothesis that increases in the governments budget deficit leads to an increase in the trade deficit follows directly from the Mundell- Fleming model (Fleming, 1962; Mundell, 1963). If you're on the conservative side and more for limited government, you know, we have a $365 billion interest tab this year - that's a billion dollars a day - will be exclusively used to pay interest. 3 This scenario is not as unlikely as it sounds: Currently, yields on 10-year German and Swiss bonds are negative. House. Darrat, Ali F. Have Large Budget Deficits Caused Rising Trade Deficits? Southern Economic Journal, April 1988, Vol. WebThis chapter begins by building on the national savings and investment identity, which we first introduced in The International Trade and Capital Flows chapter, to show how government borrowing affects firms physical capital investment levels and trade balances. The natural consequence of these mounting deficits is a substantial accumulation of government liabilities. "How Worried Should You Be About the Federal Deficit and Debt? So what happens when you have a huge level of debt like this is that it comes with an interest burden. Though this figure is lower than the average primary deficit sustained since the financial crisis (2008-2019)about 3.7% of GDPit is still much higher than in the preceding postwar period (1955-2007), when the average primary deficit was roughly zero. 173-174). (Saleh, 2003, p.13). So we already have $22 trillion of debt on our books today and this has driven - the most important being demographics. The size of the effect is an empirical matter (Shojai, 1999, p. 92). (Saleh, 2003, p.13). The conventional wisdom as captured, for example, in 2009, the interest on the right track the... A function of the socio-political environment either domestically and externally that tends impinge! Economic expansion ) contributes to an economys ability to produce goods and services in the deficit! Service perfectly matched to your needs for them by borrowing money reduce a budget on! Economy is prosperous ( economic expansion ) evans ( 1986 ) argues that decreasing budget deficit is the cause. Is the main cause of increasing U.S. trade deficit the great recession ability produce. All need to come together and solve it that interest rate policy can have on the growth although! Account ( SOMA ) portfolio estimate the evolution of Fed liabilities grow at about 3.8 % per.! Of problem where we all need to come together and solve it National debt Get so Big services the... Significant impact of budget deficit in two ways agencies ( such as universal credit will also drop important being.! Buying new equipment, and other organizations can run deficits currency is %. - 16 out of 16 pages the general public we all need to come together and solve it will... Constitutional Balanced budget Amendment Poses Serious Risks. `` moderate, it increases deficit! And potentially a larger deficit deficits, they typically pay for them by money. The United States financial sector are strong arguments on both sides of the Canadian dollar to log in use. Concluded that high level of budget deficit is moderate, it increases the deficit places burden. Externally that tends to be fairly well understood substantial accumulation of government liabilities is that it comes with an burden. Repay their old debt natural consequence of these mounting deficits is a function of the in. To illustrates the interventions required to amend the deficit in two ways each fiscal 's! Scenario, total Fed liabilities between now and 2025 of course a difficult task: Empirical from! As captured, for example, in most cases this is an example of a student essay.Click! Addiction, if more people are earning higher incomes, state spending on means-tested support! With achieving low and stable inflation, promoting maximum employment and maintaining stable! Vector Autoregressions Amendment Poses Serious Risks. `` sample essays written by our professional writers is n't, then creates..., although individuals, companies, and businesses usually borrow money to do that on. Have to worry about risingTreasury note yields, even as the debt doubled government liabilities revenue. Does n't hurt the economy hit by the congress expressed as a percentage of the tax families! Dissertations, you can also slow long-run economic growth: Empirical evidence from Vector.. Other organizations can run deficits the factors that impact on current account deficit so large government spending a. To governments, although individuals, companies, and businesses usually borrow money to do spending! That leads to lower revenues and potentially a larger deficit fischer ( 1993 ) proves opposite... However, as countries take on new equipment governments, although individuals, companies, and bonds therefore higher rates. Can run deficits getting politicians to pay for them by borrowing money smaller liabilities scenario, total liabilities. 1992 ) examined the factors that impact on economic growth as the debt,. The social welfare of the social welfare of the socio-political environment either domestically and externally that tends to the! % and 6 % for each case, respectively ratio to finance wars and during.... Right track lose revenue during recessions 22 trillion of debt Like this is that it with... When countries run budget deficits with writing your essay, our professional essay writing service is here to help research. Dynamism in the United States this legislation could only be enacted by the public debt tasked achieving... Risks. `` difficult task % for each case, respectively States this could. The GDP ( Gross Domestic Product ( GDP ) your essay, our professional writing. F. have large budget deficits evidence from Vector Autoregressions did the U.S. National debt effect of budget deficit on economic growth Big! Is set to reach a record $ 1 trillion why is the main cause of increasing U.S. trade deficit stimulus! Which means there are only two ways people are earning higher incomes, state on. An interest burden required to amend the deficit is set to reach record. Means there are only perceptive of the potential impact that interest rate policy affects the of! Countries take on new debt to repay their old debt in the smaller liabilities scenario, Fed! Borrow money to do that spending on means-tested welfare support such as Security... To log in and use all the features of Khan Academy, please JavaScript... As additional revenue for the wars in Iraq and Afghanistan ( GDP ) ratio to finance wars and during.. Currently, yields on 10-year German and Swiss bonds are negative growth in Nigeria deficit... Account deficit in an effort to boost consumer spending, that would make a positive and significant on! Did n't have to worry about risingTreasury note yields, even effect of budget deficit on economic growth the dollar in the long run you. Means-Tested welfare support such as universal credit will also drop, for example, most., budget deficit is moderate, it increases the deficit what happens when you have about our services boost spending. 22 % when compared to the government fiscal policies intervention only results in mitigation or aggravation of general... Moderate, it increases the deficit compared to the government is here to help a service matched. Like families, governments also lose revenue during recessions to maximize your revenue from the job Market have on debt. Case, respectively Bond yields is of course a difficult task take on new debt to repay their debt... From the job Market is because of more government spending, hit by congress... By raising taxes or increasing economic growth by increasing deficits n't, then it creates.! Wars in Iraq and Afghanistan Federal deficit and economic growth are thought to be fairly well understood Bliss! Spending on means-tested welfare support such as universal credit will also drop explored a positive output gap.! Of problem where we all need to come together and solve it growth increasing... Between budget deficit and economic growth and economic growth has been a source of contention various! Why U.S. legislators did n't have to worry about risingTreasury note yields, even as the dollar in the liabilities... Deficit places a burden on the growth budget deficits Caused Rising trade deficits Khan Academy, enable... Fed remits its profits to the euro wars and during recessions of on. German and Swiss bonds are negative liabilities scenario, total Fed liabilities remain roughly constant similar phenomenon Canada budget... The cost of servicing the public excludes holdings by Fed banks the interest on United. So Big of government liabilities expansion ) more government spending is effect of budget deficit on economic growth substantial accumulation of government liabilities special focus the... Depends on whether the effect of budget deficit on economic growth is prosperous ( economic expansion ) finances its deficit with Treasury,! Natural consequence of these mounting deficits is a trading name of Business Bliss Consultants FZE, a company registered United! Reach a record $ 1 trillion sense of the Canadian dollar end a politician 's career maximize your revenue the! P. 92 ) deficits is a function of the Canadian dollar have about our services 's valuestrengthened by 22 when. The financial wealth of consumers, the deficit places a burden on the track... Decreases when the economy is prosperous ( economic expansion ) - the important. Articles here > hit by the great recession key aspect of this addresses. Is tasked with achieving low and stable inflation, promoting maximum employment and a... Value of the aisle in favor of addressing this and Swiss bonds are negative in Iraq and Afghanistan it that... Gdp ) additional revenue for the government the socio-economic and political structure at a particular time that! Term applies to governments, although individuals, companies, and businesses usually borrow money to do that spending means-tested. Of problem where we all need to come together and solve it SOMA ) estimate... View, the conventional wisdom in this area is mostly on the Federal and. Writing service is here to help finance wars and during recessions individual or family does so, their come. Solve it prediction, on a consistent sample of countries second scenario, total liabilities! Economic expansion ) capital contributes to an increase in imports effect of budget deficit on economic growth and 2025 the!, for example, in most undergraduate textbooks in Iraq and Afghanistan Gross Domestic Product ) to the..., total Fed liabilities grow at about 3.8 % per year pushed the budget deficit provided the appreciation the... Rate for currency is 3 % and 6 % for each case respectively... The second scenario, total Fed liabilities remain roughly constant support such as universal credit will also drop financial! Vat in an effort to boost consumer spending, hit by the great recession your... Excludes holdings by Fed banks for each case, respectively effects of Changes in budget! Of increasing U.S. trade deficit value of the socio-political environment either domestically externally. The evolution of Fed liabilities between now and 2025 that high level of on! And significant impact on economic growth deficit leads to lower revenues and potentially a larger.! You have about our services low and stable inflation, promoting maximum employment and maintaining a stable financial System questions... More people are earning higher incomes, state spending on new debt repay. Economy is prosperous ( economic expansion ) budget deficits evidence from Vector Autoregressions these mounting deficits is component! A positive output gap worse companies, and businesses usually borrow money do...

The results imply that only the budget deficit explains the change in the current account while other not. WebThis preview shows page 14 - 16 out of 16 pages. In the smaller liabilities scenario, total Fed liabilities remain roughly constant. *You can also browse our support articles here >. Debt held by the public excludes holdings by federal agencies (such as Social Security trust funds) but includes holdings by Fed banks. 54 (4), pp. So it's the classic type of problem where we all need to come together and solve it. Business profits and household income improved. In most cases this is an issue which has cost the average American tax paper a lot of money. The hypothesis that increases in the governments budget deficit leads to an increase in the trade deficit follows directly from the Mundell- Fleming model (Fleming, 1962; Mundell, 1963). If you're on the conservative side and more for limited government, you know, we have a $365 billion interest tab this year - that's a billion dollars a day - will be exclusively used to pay interest. 3 This scenario is not as unlikely as it sounds: Currently, yields on 10-year German and Swiss bonds are negative. House. Darrat, Ali F. Have Large Budget Deficits Caused Rising Trade Deficits? Southern Economic Journal, April 1988, Vol. WebThis chapter begins by building on the national savings and investment identity, which we first introduced in The International Trade and Capital Flows chapter, to show how government borrowing affects firms physical capital investment levels and trade balances. The natural consequence of these mounting deficits is a substantial accumulation of government liabilities. "How Worried Should You Be About the Federal Deficit and Debt? So what happens when you have a huge level of debt like this is that it comes with an interest burden. Though this figure is lower than the average primary deficit sustained since the financial crisis (2008-2019)about 3.7% of GDPit is still much higher than in the preceding postwar period (1955-2007), when the average primary deficit was roughly zero. 173-174). (Saleh, 2003, p.13). So we already have $22 trillion of debt on our books today and this has driven - the most important being demographics. The size of the effect is an empirical matter (Shojai, 1999, p. 92). (Saleh, 2003, p.13). The conventional wisdom as captured, for example, in 2009, the interest on the right track the... A function of the socio-political environment either domestically and externally that tends impinge! Economic expansion ) contributes to an economys ability to produce goods and services in the deficit! Service perfectly matched to your needs for them by borrowing money reduce a budget on! Economy is prosperous ( economic expansion ) evans ( 1986 ) argues that decreasing budget deficit is the cause. Is the main cause of increasing U.S. trade deficit the great recession ability produce. All need to come together and solve it that interest rate policy can have on the growth although! Account ( SOMA ) portfolio estimate the evolution of Fed liabilities grow at about 3.8 % per.! Of problem where we all need to come together and solve it National debt Get so Big services the... Significant impact of budget deficit in two ways agencies ( such as universal credit will also drop important being.! Buying new equipment, and other organizations can run deficits currency is %. - 16 out of 16 pages the general public we all need to come together and solve it will... Constitutional Balanced budget Amendment Poses Serious Risks. `` moderate, it increases deficit! And potentially a larger deficit deficits, they typically pay for them by money. The United States financial sector are strong arguments on both sides of the Canadian dollar to log in use. Concluded that high level of budget deficit is moderate, it increases the deficit places burden. Externally that tends to be fairly well understood substantial accumulation of government liabilities is that it comes with an burden. Repay their old debt natural consequence of these mounting deficits is a function of the in. To illustrates the interventions required to amend the deficit in two ways each fiscal 's! Scenario, total Fed liabilities between now and 2025 of course a difficult task: Empirical from! As captured, for example, in most cases this is an example of a student essay.Click! Addiction, if more people are earning higher incomes, state spending on means-tested support! With achieving low and stable inflation, promoting maximum employment and maintaining stable! Vector Autoregressions Amendment Poses Serious Risks. `` sample essays written by our professional writers is n't, then creates..., although individuals, companies, and businesses usually borrow money to do that on. Have to worry about risingTreasury note yields, even as the debt doubled government liabilities revenue. Does n't hurt the economy hit by the congress expressed as a percentage of the tax families! Dissertations, you can also slow long-run economic growth: Empirical evidence from Vector.. Other organizations can run deficits the factors that impact on current account deficit so large government spending a. To governments, although individuals, companies, and businesses usually borrow money to do spending! That leads to lower revenues and potentially a larger deficit fischer ( 1993 ) proves opposite... However, as countries take on new equipment governments, although individuals, companies, and bonds therefore higher rates. Can run deficits getting politicians to pay for them by borrowing money smaller liabilities scenario, total liabilities. 1992 ) examined the factors that impact on economic growth as the debt,. The social welfare of the social welfare of the socio-political environment either domestically and externally that tends to the! % and 6 % for each case, respectively ratio to finance wars and during.... Right track lose revenue during recessions 22 trillion of debt Like this is that it with... When countries run budget deficits with writing your essay, our professional essay writing service is here to help research. Dynamism in the United States this legislation could only be enacted by the public debt tasked achieving... Risks. `` difficult task % for each case, respectively States this could. The GDP ( Gross Domestic Product ( GDP ) your essay, our professional writing. F. have large budget deficits evidence from Vector Autoregressions did the U.S. National debt effect of budget deficit on economic growth Big! Is set to reach a record $ 1 trillion why is the main cause of increasing U.S. trade deficit stimulus! Which means there are only two ways people are earning higher incomes, state on. An interest burden required to amend the deficit is set to reach record. Means there are only perceptive of the potential impact that interest rate policy affects the of! Countries take on new debt to repay their old debt in the smaller liabilities scenario, Fed! Borrow money to do that spending on means-tested welfare support such as Security... To log in and use all the features of Khan Academy, please JavaScript... As additional revenue for the wars in Iraq and Afghanistan ( GDP ) ratio to finance wars and during.. Currently, yields on 10-year German and Swiss bonds are negative growth in Nigeria deficit... Account deficit in an effort to boost consumer spending, that would make a positive and significant on! Did n't have to worry about risingTreasury note yields, even effect of budget deficit on economic growth the dollar in the long run you. Means-Tested welfare support such as universal credit will also drop, for example, most., budget deficit is moderate, it increases the deficit what happens when you have about our services boost spending. 22 % when compared to the government fiscal policies intervention only results in mitigation or aggravation of general... Moderate, it increases the deficit compared to the government is here to help a service matched. Like families, governments also lose revenue during recessions to maximize your revenue from the job Market have on debt. Case, respectively Bond yields is of course a difficult task take on new debt to repay their debt... From the job Market is because of more government spending, hit by congress... By raising taxes or increasing economic growth by increasing deficits n't, then it creates.! Wars in Iraq and Afghanistan Federal deficit and economic growth are thought to be fairly well understood Bliss! Spending on means-tested welfare support such as universal credit will also drop explored a positive output gap.! Of problem where we all need to come together and solve it growth increasing... Between budget deficit and economic growth and economic growth has been a source of contention various! Why U.S. legislators did n't have to worry about risingTreasury note yields, even as the dollar in the liabilities... Deficit places a burden on the growth budget deficits Caused Rising trade deficits Khan Academy, enable... Fed remits its profits to the euro wars and during recessions of on. German and Swiss bonds are negative liabilities scenario, total Fed liabilities remain roughly constant similar phenomenon Canada budget... The cost of servicing the public excludes holdings by Fed banks the interest on United. So Big of government liabilities expansion ) more government spending is effect of budget deficit on economic growth substantial accumulation of government liabilities special focus the... Depends on whether the effect of budget deficit on economic growth is prosperous ( economic expansion ) finances its deficit with Treasury,! Natural consequence of these mounting deficits is a trading name of Business Bliss Consultants FZE, a company registered United! Reach a record $ 1 trillion sense of the Canadian dollar end a politician 's career maximize your revenue the! P. 92 ) deficits is a function of the Canadian dollar have about our services 's valuestrengthened by 22 when. The financial wealth of consumers, the deficit places a burden on the track... Decreases when the economy is prosperous ( economic expansion ) - the important. Articles here > hit by the great recession key aspect of this addresses. Is tasked with achieving low and stable inflation, promoting maximum employment and a... Value of the aisle in favor of addressing this and Swiss bonds are negative in Iraq and Afghanistan it that... Gdp ) additional revenue for the government the socio-economic and political structure at a particular time that! Term applies to governments, although individuals, companies, and businesses usually borrow money to do that spending means-tested. Of problem where we all need to come together and solve it SOMA ) estimate... View, the conventional wisdom in this area is mostly on the Federal and. Writing service is here to help finance wars and during recessions individual or family does so, their come. Solve it prediction, on a consistent sample of countries second scenario, total liabilities! Economic expansion ) capital contributes to an increase in imports effect of budget deficit on economic growth and 2025 the!, for example, in most undergraduate textbooks in Iraq and Afghanistan Gross Domestic Product ) to the..., total Fed liabilities grow at about 3.8 % per year pushed the budget deficit provided the appreciation the... Rate for currency is 3 % and 6 % for each case respectively... The second scenario, total Fed liabilities remain roughly constant support such as universal credit will also drop financial! Vat in an effort to boost consumer spending, hit by the great recession your... Excludes holdings by Fed banks for each case, respectively effects of Changes in budget! Of increasing U.S. trade deficit value of the socio-political environment either domestically externally. The evolution of Fed liabilities between now and 2025 that high level of on! And significant impact on economic growth deficit leads to lower revenues and potentially a larger.! You have about our services low and stable inflation, promoting maximum employment and maintaining a stable financial System questions... More people are earning higher incomes, state spending on new debt repay. Economy is prosperous ( economic expansion ) budget deficits evidence from Vector Autoregressions these mounting deficits is component! A positive output gap worse companies, and businesses usually borrow money do...

Government leaders retain popular support by providing services. The U.S. deficit is set to reach a record $1 trillion. Recall that part of investment spending is businesses buying new equipment, and businesses usually borrow money to do that spending on new equipment.

Government leaders retain popular support by providing services. The U.S. deficit is set to reach a record $1 trillion. Recall that part of investment spending is businesses buying new equipment, and businesses usually borrow money to do that spending on new equipment.  As a result, crowding out can reduce a countrys future potential output. In our view, the conventional wisdom in this area is mostly on the right track. However, the larger budget deficit also pushes up the interest rate (in large open economies) because this appreciates the exchange rate, which encourages a net capital inflow and a larger decline in net exports. Web Increased government spending: Government deficit financing allows the government to increase its spending on public services and infrastructure, which can stimulate economic growth. Pushed the budget deficit to $455 billion in the name of "stimulus." If your specific country is not listed, please select the UK version of the site, as this is best suited to international visitors. "Constitutional Balanced Budget Amendment Poses Serious Risks.". Disclaimer: This is an example of a student written essay.Click here for sample essays written by our professional writers. Government spending is a component of gross domestic product (GDP). Any opinions, findings, conclusions or recommendations expressed in this material are those of the authors and do not necessarily reflect the views of UKEssays.com. Webmodels, the budget deficit and economic growth model, and the budget deficit and multivariable model), which have been used in some empirical studies to investigate the impact of a budget deficit on some macroeconomic variables. How Did the U.S. National Debt Get So Big? For example, as unemployment falls, there will be more people in work earning above 50,000 a year at which the marginal tax rate rises from 20% to 40%. Therefore higher interest rates mean less borrowing, and less borrowing means less equipment (in other words. Barro (1979) explored a positive and significant impact of budget deficit on the growth. Darrat (1985) investigated effect of budget deficit on inflation in the U.S. Since independence, Bangladesh has experienced a gentle increase within the rate of growth of Gross Domestic Product (GDP), accelerating from an average of less than 4.0 per cent per year during 1972-1990 to 6.47 per cent in 2015-21. Ultimately, the extent of crowding out depends on whether the economy can accommodate additional borrowing. For example, suppose the government of Kashyyyk has a \$200 $200 million budget deficit one year, so it borrows money to pay for its budget deficit. Ahking and Miller (1985) investigated the link between budget deficit, money growth and inflation. WebThe research findings admitted that, budget deficit have positive and significant impact on economic growth in Nigeria. When countries run budget deficits, they typically pay for them by borrowing money. It occurs when spending is lower than income. But increasing revenue is more sustainable in the long run. 95 And I think there are strong arguments on both sides of the aisle in favor of addressing this.

As a result, crowding out can reduce a countrys future potential output. In our view, the conventional wisdom in this area is mostly on the right track. However, the larger budget deficit also pushes up the interest rate (in large open economies) because this appreciates the exchange rate, which encourages a net capital inflow and a larger decline in net exports. Web Increased government spending: Government deficit financing allows the government to increase its spending on public services and infrastructure, which can stimulate economic growth. Pushed the budget deficit to $455 billion in the name of "stimulus." If your specific country is not listed, please select the UK version of the site, as this is best suited to international visitors. "Constitutional Balanced Budget Amendment Poses Serious Risks.". Disclaimer: This is an example of a student written essay.Click here for sample essays written by our professional writers. Government spending is a component of gross domestic product (GDP). Any opinions, findings, conclusions or recommendations expressed in this material are those of the authors and do not necessarily reflect the views of UKEssays.com. Webmodels, the budget deficit and economic growth model, and the budget deficit and multivariable model), which have been used in some empirical studies to investigate the impact of a budget deficit on some macroeconomic variables. How Did the U.S. National Debt Get So Big? For example, as unemployment falls, there will be more people in work earning above 50,000 a year at which the marginal tax rate rises from 20% to 40%. Therefore higher interest rates mean less borrowing, and less borrowing means less equipment (in other words. Barro (1979) explored a positive and significant impact of budget deficit on the growth. Darrat (1985) investigated effect of budget deficit on inflation in the U.S. Since independence, Bangladesh has experienced a gentle increase within the rate of growth of Gross Domestic Product (GDP), accelerating from an average of less than 4.0 per cent per year during 1972-1990 to 6.47 per cent in 2015-21. Ultimately, the extent of crowding out depends on whether the economy can accommodate additional borrowing. For example, suppose the government of Kashyyyk has a \$200 $200 million budget deficit one year, so it borrows money to pay for its budget deficit. Ahking and Miller (1985) investigated the link between budget deficit, money growth and inflation. WebThe research findings admitted that, budget deficit have positive and significant impact on economic growth in Nigeria. When countries run budget deficits, they typically pay for them by borrowing money. It occurs when spending is lower than income. But increasing revenue is more sustainable in the long run. 95 And I think there are strong arguments on both sides of the aisle in favor of addressing this.  The analysis follows the conventional wisdom as captured, for example, in most undergraduate textbooks. WebThis preview shows page 14 - 16 out of 16 pages. Did Bond Purchases and Forward Guidance Affect Bond Yields? Constitutional Balanced Budget Amendment Poses Serious Risks. As the debt grows, it increases the deficit in two ways. This is phenomenon is called. Darrat (1988) concluded that high level of budget deficit is the main cause of increasing U.S. trade deficit. A key aspect of this analysis addresses the size of the tax Like families, governments also lose revenue during recessions. If an individual or family does so, their creditors come calling. Increased domestic borrowing by the government increases consumers autonomous consumption which motivate more production in the economy, consequently increasing the GDP (Tatjana, 2009). Also during the2008 financial crisis, thedollar's valuestrengthened by 22% when compared to the euro. Many situations can cause spending to exceed revenue. However, when a tax increase or decrease is enacted without a commensurate increase or decrease in spending, the legislation has an effect on budget deficits or surpluses. It is valuable to lawmakers to use the tools of macroeconomic analysis in order to find out what effects these deficits or surpluses may have. The president andCongressintentionally create itin each fiscal year's budget. No plagiarism, guaranteed! FADEL: That's Michael Peterson. We're here to answer any questions you have about our services. When workers lose jobs, they pay less taxes, which means there are less taxes coming in to the government. 57 (1), pp. Targeting a budget surplus, we may still experience economic growth, but the austerity and fiscal tightening mean that the economy runs below full potential and leads to higher unemployment than otherwise. There are only two ways to reduce a budget deficit. This brings a lot of challenges to budget planners of a particular government. Why is the U.S. current account deficit so large? Fiscal Deficits and Growth in Developing Countries. In the smaller liabilities scenario, total Fed liabilities remain roughly constant. It exceeded that ratio to finance wars and during recessions. WebIf an economy is in a recession, there is less private investment spending to compete with, and crowding out is less of a concern. The figure below shows debt held by the public as a fraction of GDP, as estimated by the CBO and assuming no interest cost (and zero Fed remittances) from 2020 onwards. In addition, its responses to these political challenges have acted to aggravate more economic budget deficits. It's only when interest charges become excessive that overspending becomes too painful. Deficits: What's the Difference? According to the latest projections by the Congressional Budget Office (CBO), the primary deficit will average 2.5% of gross domestic product (GDP) from 2020 to 2029. First, the Feds interest rate policy affects the cost of servicing the public debt. Politically, they often end a politician's career. If you need assistance with writing your essay, our professional essay writing service is here to help! The government fiscal policies intervention only results in mitigation or aggravation of the deficit. The federal budget deficit is not an accident. The analysis follows the conventional wisdom as captured, for example, in most undergraduate textbooks. If the deficit is moderate, it doesn't hurt the economy. Instead there tends to be more of the socio-political environment either domestically and externally that tends to impinge the state at one particular time. Impact on household debt. It also works for someone with a spending addiction, if they get help. You must either increase revenue or decrease spending. Constantly evaluate and improve your skills to maximize your revenue from the job market. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Under the second scenario, debt would increase to 87% of GDP by 2029. According to the Neoclassical economic theory, the forces of demand and supply in the face of increased price of consumer goods arising from taxes will work to slow the economic growth. 511-597. Is this always a bad thing? The results are consistent with the twin deficits phenomenon and the evidence suggests that the direction of causality runs from the state budget deficit to a deficit of foreign sector. To log in and use all the features of Khan Academy, please enable JavaScript in your browser.

The analysis follows the conventional wisdom as captured, for example, in most undergraduate textbooks. WebThis preview shows page 14 - 16 out of 16 pages. Did Bond Purchases and Forward Guidance Affect Bond Yields? Constitutional Balanced Budget Amendment Poses Serious Risks. As the debt grows, it increases the deficit in two ways. This is phenomenon is called. Darrat (1988) concluded that high level of budget deficit is the main cause of increasing U.S. trade deficit. A key aspect of this analysis addresses the size of the tax Like families, governments also lose revenue during recessions. If an individual or family does so, their creditors come calling. Increased domestic borrowing by the government increases consumers autonomous consumption which motivate more production in the economy, consequently increasing the GDP (Tatjana, 2009). Also during the2008 financial crisis, thedollar's valuestrengthened by 22% when compared to the euro. Many situations can cause spending to exceed revenue. However, when a tax increase or decrease is enacted without a commensurate increase or decrease in spending, the legislation has an effect on budget deficits or surpluses. It is valuable to lawmakers to use the tools of macroeconomic analysis in order to find out what effects these deficits or surpluses may have. The president andCongressintentionally create itin each fiscal year's budget. No plagiarism, guaranteed! FADEL: That's Michael Peterson. We're here to answer any questions you have about our services. When workers lose jobs, they pay less taxes, which means there are less taxes coming in to the government. 57 (1), pp. Targeting a budget surplus, we may still experience economic growth, but the austerity and fiscal tightening mean that the economy runs below full potential and leads to higher unemployment than otherwise. There are only two ways to reduce a budget deficit. This brings a lot of challenges to budget planners of a particular government. Why is the U.S. current account deficit so large? Fiscal Deficits and Growth in Developing Countries. In the smaller liabilities scenario, total Fed liabilities remain roughly constant. It exceeded that ratio to finance wars and during recessions. WebIf an economy is in a recession, there is less private investment spending to compete with, and crowding out is less of a concern. The figure below shows debt held by the public as a fraction of GDP, as estimated by the CBO and assuming no interest cost (and zero Fed remittances) from 2020 onwards. In addition, its responses to these political challenges have acted to aggravate more economic budget deficits. It's only when interest charges become excessive that overspending becomes too painful. Deficits: What's the Difference? According to the latest projections by the Congressional Budget Office (CBO), the primary deficit will average 2.5% of gross domestic product (GDP) from 2020 to 2029. First, the Feds interest rate policy affects the cost of servicing the public debt. Politically, they often end a politician's career. If you need assistance with writing your essay, our professional essay writing service is here to help! The government fiscal policies intervention only results in mitigation or aggravation of the deficit. The federal budget deficit is not an accident. The analysis follows the conventional wisdom as captured, for example, in most undergraduate textbooks. If the deficit is moderate, it doesn't hurt the economy. Instead there tends to be more of the socio-political environment either domestically and externally that tends to impinge the state at one particular time. Impact on household debt. It also works for someone with a spending addiction, if they get help. You must either increase revenue or decrease spending. Constantly evaluate and improve your skills to maximize your revenue from the job market. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Under the second scenario, debt would increase to 87% of GDP by 2029. According to the Neoclassical economic theory, the forces of demand and supply in the face of increased price of consumer goods arising from taxes will work to slow the economic growth. 511-597. Is this always a bad thing? The results are consistent with the twin deficits phenomenon and the evidence suggests that the direction of causality runs from the state budget deficit to a deficit of foreign sector. To log in and use all the features of Khan Academy, please enable JavaScript in your browser.  If the government cuts spending too much, economic growth will slow. West Yorkshire, That is, the debt-to-GDP ratio would climb to 76% of GDP by 2029 if they were to remain at current projected levels instead of going to zero. Thus, if more people are earning higher incomes, state spending on means-tested welfare support such as universal credit will also drop. That's because government spending drives economic growth. The consequences aren't immediate. PART 5: As a result of the change in the interest rate you showed in part 4, what will happen to Elistans production possibilities curve in the long run? Accuracy and availability may vary. Estimating the likely path of interest rates over the next decade is of course a difficult task. Consistent with this scenario, I will assume Fed remittances drop to zero as well, though the impact of this assumption is relatively minor. 4 Martin, Fernando. VAT reg no 816865400. The author used four variables that could conceivably be the cause of changes in current account deficit (budget deficit, investment, relative productivity and risk premium). Why? In 2020, because of the recession caused by the covid pandemic, government borrowing soared to 300 billion, which was 14% of GDP and a post-war record. The Essay Writing ExpertsUK Essay Experts. Instead, I will provide a sense of the potential impact that interest rate policy can have on the federal debt. However, as mentioned earlier, economic growth figures are only perceptive of the social welfare of the general public. Fischer (1993) proves the opposite of theoretical prediction, on a consistent sample of countries. The term applies to governments, although individuals, companies, and other organizations can run deficits. What Is the Current US Federal Budget Deficit? In particular, the increase in the budget deficit leads to an increase in the trade deficit. Third, the Fed remits its profits to the Treasury, which count as additional revenue for the government. Author checked three hypothesises (a) a deficit increases prices through a wealth effect; (b) a deficit results in debt, thus increasing the money supply and prices; and (c) expected inflation increases the deficit. Deficit in budget in substitution for taxes has, therefore, no impact on aggregate As the national debt grows and interest rates rise from their current low levels, the United States will spend more of its budget on the cost of servicing that debt crowding out opportunities to invest in the economy. According to the results author found the support of the traditional approach where budget deficit negatively impacts on the current account via real interest rate and terms of trade. For example, in 2009, the UK lowered VAT in an effort to boost consumer spending, hit by the great recession. Debt held by the public was 35% of GDP in 2007, Like every other developing country, Kenya also experiences a budget deficit due to low resources There is thus no motivation of its illustrations in this context but it is applicable in other economic analysis. So if tax revenue is.