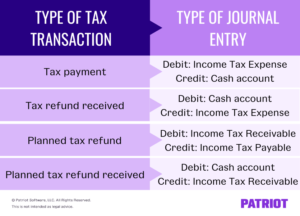

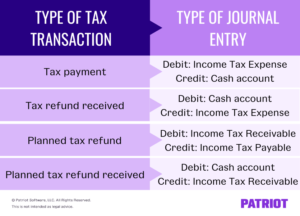

where is john crace this week; timberworks lumberjack show CC ENMOD and CC TXMOD will aid in identifying cases in the Rejects Inventory. When necessary, employees must order the return to verify the direct deposit account information. DO NOT offer the toll free refund hotline, 800-829-1954, as an option unless the taxpayer states they do not have a computer, or internet access. If ERS status is 421/422/423/424: the taxpayers reply has been received. TurboTax Live Basic Full Service. Advise the taxpayer to allow 16 weeks from the date of their call before calling the IRS back for the status of their return, unless directed by one of the refund automated systems. For more information regarding CP 80, see IRM 21.2.4.3.44.2, CP80/CP080 Resolution and AMRH12 Reply Received. Change made due to programming change to Wheres My Refund. Conduct the necessary account research and provide assistance according to the applicable IRM procedures. You'll Manual refunds (TC 840) may also be issued via direct deposit in certain situations, i.e., hardships. They will ask some verification questions and research your federal tax account. If a "C" shows, check CC IMFOLT to see if the refund has been issued.  Refer to IRM 21.4.6, Refund Offset. If the ERS time frame has passed and the return has not posted, see IRM 3.12.37-13, Researching SCCF. If research determines taxpayer is entitled to a refund, provide explanation. For the cutoff days and time frames for BMF CC NOREF, see IRM 3.14.2.6.1 (2) and (6), Refund Intercept using CC NOREF. Non-TPP assistors see IRM 25.25.6.6, Non Taxpayer Protection Program (TPP) Telephone Assistors Response to Taxpayers. Balance due more than $50. In the case of a split refund, one refund may be issued as a direct deposit and one refund may be issued as a paper check if the financial institution is rejecting the deposit. If additional action is required (i.e., injured spouse claim, 1040-X) request that the refund be held, monitor the account and take appropriate follow-up action once the return has posted to MFT 30. For example, IRFOF will provide the contact number 800-829-0582 if one or more math errors, or other conditions, are present on the account. To research refund inquiries concerning non-receipt of direct deposit, see IRM 21.4.1.5.7, Direct Deposits - General Information. All online tax preparation software. Advise the taxpayer that the return has been selected for further review and that well need to speak with him/her to validate the information that was submitted. The following section contains procedures for resolving taxpayer refund inquiries. The OCC Customer Assistance Group may answer questions, offer guidance, and assist consumers in resolving complaints about National Banks. Provide the taxpayer with the irs.gov web address www.irs.gov/covidstatus to check the current operational status due to Covid-19. If your research shows that the account is in "Status 12" with a credit balance on the module, a freeze code will be on the account. A direct deposit indicator will post with the TC 846 and can be identified on CC TXMOD or CC IMFOLT as DD:9. (14) IRM 21.4.1.4.1.2.3 Removed Official Use Only designation from "Note" linking to SERP page. If the bank does not respond, follow erroneous refund procedures in IRM 21.4.5, Erroneous Refunds. IPU 21U1336 issued 12-13-2021. Review the account markers to determine refund status. If the bank does not respond within 15 calendar days of the letter, contact the bank by phone to determine the status of the request. Advise the taxpayer they should also contact the financial institution. For information regarding Debtor Master File (DMF), Treasury Offset Program (TOP) Offset Bypass Refund, Hardship and Injured Spouse, see IRM 21.4.6, Refund Offset. This is a single event page with sample content. Use CC "IMFOLV" to obtain retention register information. If one of the following conditions occur during the initial return processing, Master File will issue (if applicable) two direct deposits if both refunds are issued in the same processing year: Unallowable condition on original return usually a -Q Freeze. Webbarbecue festival 2022; olivia clare friedman net worth. If Field 30 shows any other to code, ask the taxpayer to call back in one week. Effective FY 2018, the RAL/RAC codes were expanded to include other Refund Advance Product codes. If taxpayer not entitled, see IRM 21.4.5, Erroneous Refunds. A direct deposit refund must be stopped no later than the Friday, one week before the scheduled date of the direct deposit. Do not issue a replacement check for the first or second round of Economic Impact Payments. Advise them not to call back before 12 weeks as no information will be available. If you cannot contact the taxpayer by telephone, use existing letters to reply to or request additional information from the taxpayer. If the case remains open in ERS and no apparent actions have been taken to resolve the taxpayer's inquiry, or the taxpayer is experiencing a financial hardship, refer to IRM 21.1.3.18, Taxpayer Advocate Service (TAS) Guidelines, and IRM 13.1.7.4, Exceptions to Taxpayer Advocate Service Criteria, before referring to TAS. TC 971 AC 111 (CC TXMOD), TRDBV shows UPC 147 RC 6 or 7 and the TP filed the return on MFT 32 or the return was GUF Voided/Deleted. 855-408-6972 (TTY) Ask Your Question Fast! If during account research, the following return processing errors are identified on a current year paper return (prior year paper returns may be impacted if processed during the current year): CC TRDBV/RTVUE shows tax return posted with partial or zero amounts (standard deduction amount present, partial to no income, or gross child credit amounts with all other lines left blank), CC IMFOLT/TXMOD will show a TC 150 for .00 (if its a balance due return, some accounts may have TC 610/TC 430 or other payments that may or may not have been refunded erroneously, if refunded youll see TC 846), The transcription errors are not ERS or math error related (if the return shows math error(s), review CC TRDBV/RTVUE for partial or zero amounts, as stated in first bullet). (1) IRM 21.4.1.1.2(1) Added policy statements for Customer Accounts Services as authorities for the IRM. The term tax refund refers to a reimbursement made to a taxpayer for any excess amount paid in taxes to the federal or state government. For additional information on these CCs, see IRM 2.3.1, Section Titles and Command Codes for IDRS Terminal Responses. Before ending the call, on Individual accounts, advise the taxpayer that the best way to get the most current information about their refund is through the automated systems, Wheres My Refund (WMR) on IRS.gov; IRS2GO (English and Spanish) for smart phones; or the Refund Hotline. If the taxpayer states they have contacted the financial institution and have not resolved the issue or they request proof of deposit, initiate a refund trace. When contacting taxpayers, refer to IRM 21.1.3, Operational Guidelines Overview, for the appropriate disclosure authorization procedures. Provide the taxpayer with the appropriate processing time frame and information about our automated Amended Return applications: Wheres My Amended Return? If not, then thank him/her for calling and end the call. Status Codes 1QA, 2QA, 3QA, 4QA - ERS record has been pulled for Quality Review. Math error condition when partial refund is issued. Advise the taxpayer you are taking the necessary steps to have their refund issued as a paper check. (17) IRM 21.4.1.4.4(2) Updated procedures not to initiate a refund trace over the phone if there is IDT involvement on the account to align with other IRM references regarding the handling of IDTVA cases. The computer will allow two direct deposits (TC 846) in the same processing year regardless of a split refund. See IRM 21.6.6.2.20.3, CP 01H Notice or Letter 12C Decedent Account Responses, for guidance. The following information provides some of the most common ERS status codes and their time frames. Contents show What does tax refund Proc mean? If both TC 971 AC 052 and TC 971 AC 152 appear on the account, use the 2 cycle delay, as the AC 052 would supersede the AC 152.

Refer to IRM 21.4.6, Refund Offset. If the ERS time frame has passed and the return has not posted, see IRM 3.12.37-13, Researching SCCF. If research determines taxpayer is entitled to a refund, provide explanation. For the cutoff days and time frames for BMF CC NOREF, see IRM 3.14.2.6.1 (2) and (6), Refund Intercept using CC NOREF. Non-TPP assistors see IRM 25.25.6.6, Non Taxpayer Protection Program (TPP) Telephone Assistors Response to Taxpayers. Balance due more than $50. In the case of a split refund, one refund may be issued as a direct deposit and one refund may be issued as a paper check if the financial institution is rejecting the deposit. If additional action is required (i.e., injured spouse claim, 1040-X) request that the refund be held, monitor the account and take appropriate follow-up action once the return has posted to MFT 30. For example, IRFOF will provide the contact number 800-829-0582 if one or more math errors, or other conditions, are present on the account. To research refund inquiries concerning non-receipt of direct deposit, see IRM 21.4.1.5.7, Direct Deposits - General Information. All online tax preparation software. Advise the taxpayer that the return has been selected for further review and that well need to speak with him/her to validate the information that was submitted. The following section contains procedures for resolving taxpayer refund inquiries. The OCC Customer Assistance Group may answer questions, offer guidance, and assist consumers in resolving complaints about National Banks. Provide the taxpayer with the irs.gov web address www.irs.gov/covidstatus to check the current operational status due to Covid-19. If your research shows that the account is in "Status 12" with a credit balance on the module, a freeze code will be on the account. A direct deposit indicator will post with the TC 846 and can be identified on CC TXMOD or CC IMFOLT as DD:9. (14) IRM 21.4.1.4.1.2.3 Removed Official Use Only designation from "Note" linking to SERP page. If the bank does not respond, follow erroneous refund procedures in IRM 21.4.5, Erroneous Refunds. IPU 21U1336 issued 12-13-2021. Review the account markers to determine refund status. If the bank does not respond within 15 calendar days of the letter, contact the bank by phone to determine the status of the request. Advise the taxpayer they should also contact the financial institution. For information regarding Debtor Master File (DMF), Treasury Offset Program (TOP) Offset Bypass Refund, Hardship and Injured Spouse, see IRM 21.4.6, Refund Offset. This is a single event page with sample content. Use CC "IMFOLV" to obtain retention register information. If one of the following conditions occur during the initial return processing, Master File will issue (if applicable) two direct deposits if both refunds are issued in the same processing year: Unallowable condition on original return usually a -Q Freeze. Webbarbecue festival 2022; olivia clare friedman net worth. If Field 30 shows any other to code, ask the taxpayer to call back in one week. Effective FY 2018, the RAL/RAC codes were expanded to include other Refund Advance Product codes. If taxpayer not entitled, see IRM 21.4.5, Erroneous Refunds. A direct deposit refund must be stopped no later than the Friday, one week before the scheduled date of the direct deposit. Do not issue a replacement check for the first or second round of Economic Impact Payments. Advise them not to call back before 12 weeks as no information will be available. If you cannot contact the taxpayer by telephone, use existing letters to reply to or request additional information from the taxpayer. If the case remains open in ERS and no apparent actions have been taken to resolve the taxpayer's inquiry, or the taxpayer is experiencing a financial hardship, refer to IRM 21.1.3.18, Taxpayer Advocate Service (TAS) Guidelines, and IRM 13.1.7.4, Exceptions to Taxpayer Advocate Service Criteria, before referring to TAS. TC 971 AC 111 (CC TXMOD), TRDBV shows UPC 147 RC 6 or 7 and the TP filed the return on MFT 32 or the return was GUF Voided/Deleted. 855-408-6972 (TTY) Ask Your Question Fast! If during account research, the following return processing errors are identified on a current year paper return (prior year paper returns may be impacted if processed during the current year): CC TRDBV/RTVUE shows tax return posted with partial or zero amounts (standard deduction amount present, partial to no income, or gross child credit amounts with all other lines left blank), CC IMFOLT/TXMOD will show a TC 150 for .00 (if its a balance due return, some accounts may have TC 610/TC 430 or other payments that may or may not have been refunded erroneously, if refunded youll see TC 846), The transcription errors are not ERS or math error related (if the return shows math error(s), review CC TRDBV/RTVUE for partial or zero amounts, as stated in first bullet). (1) IRM 21.4.1.1.2(1) Added policy statements for Customer Accounts Services as authorities for the IRM. The term tax refund refers to a reimbursement made to a taxpayer for any excess amount paid in taxes to the federal or state government. For additional information on these CCs, see IRM 2.3.1, Section Titles and Command Codes for IDRS Terminal Responses. Before ending the call, on Individual accounts, advise the taxpayer that the best way to get the most current information about their refund is through the automated systems, Wheres My Refund (WMR) on IRS.gov; IRS2GO (English and Spanish) for smart phones; or the Refund Hotline. If the taxpayer states they have contacted the financial institution and have not resolved the issue or they request proof of deposit, initiate a refund trace. When contacting taxpayers, refer to IRM 21.1.3, Operational Guidelines Overview, for the appropriate disclosure authorization procedures. Provide the taxpayer with the appropriate processing time frame and information about our automated Amended Return applications: Wheres My Amended Return? If not, then thank him/her for calling and end the call. Status Codes 1QA, 2QA, 3QA, 4QA - ERS record has been pulled for Quality Review. Math error condition when partial refund is issued. Advise the taxpayer you are taking the necessary steps to have their refund issued as a paper check. (17) IRM 21.4.1.4.4(2) Updated procedures not to initiate a refund trace over the phone if there is IDT involvement on the account to align with other IRM references regarding the handling of IDTVA cases. The computer will allow two direct deposits (TC 846) in the same processing year regardless of a split refund. See IRM 21.6.6.2.20.3, CP 01H Notice or Letter 12C Decedent Account Responses, for guidance. The following information provides some of the most common ERS status codes and their time frames. Contents show What does tax refund Proc mean? If both TC 971 AC 052 and TC 971 AC 152 appear on the account, use the 2 cycle delay, as the AC 052 would supersede the AC 152.  IRS Transcript Code 570 If the ERS time frame has passed and the return has not posted, see IRM 3.12.37-13, Researching SCCF. Financial institution's RTN or Acct. Refer to IRM 2.4.37, Command Code NOREF Overview, for a complete description and input requirements. Provide the 10 week processing time frame to receive a notice or their refund. For input instructions, refer to Command Code SCFTR Job Aid. 414-365-9616 (International). If the letter was not received or lost, advise the taxpayer to provide a letter of explanation and include their TIN. Advise the taxpayer of your actions and when to expect their refund. Address shown on the original return and new address if appropriate. tax proc fee disb 2021

IRS Transcript Code 570 If the ERS time frame has passed and the return has not posted, see IRM 3.12.37-13, Researching SCCF. Financial institution's RTN or Acct. Refer to IRM 2.4.37, Command Code NOREF Overview, for a complete description and input requirements. Provide the 10 week processing time frame to receive a notice or their refund. For input instructions, refer to Command Code SCFTR Job Aid. 414-365-9616 (International). If the letter was not received or lost, advise the taxpayer to provide a letter of explanation and include their TIN. Advise the taxpayer of your actions and when to expect their refund. Address shown on the original return and new address if appropriate. tax proc fee disb 2021  If a taxpayer requests assistance with the IRS automated systems listed above, do not attempt to access the system for them. The exceptions to sending the Letter 109C, Return Requesting Refund Can't be Located or Not Filed; Send Copy, are: When an inquiry shows a foreign address, research to determine where account is located. Select category, Refund then select "SPIDT". Free Edition tax filing. See IRM 21.4.1.5.1, Refund Not Sent or Amount Differs, for additional information. Do not refer these cases to TAS unless the taxpayer asks to be transferred to TAS and the case meets TAS criteria. Verify the routing transit number (RTN) or numbers on CC IMFOBT. If the amount of the refund is increased because of a math error, the savings bonds will be issued, and the additional amount will be refunded in the form of a paper check or direct deposit if designated on the Form 8888. It will not appear on CC IMFOLT. IRM 25.23.1.7, Taxpayers Who Are Victims of a Data Breach. If the taxpayer has not filed their 2021 tax return, follow IRM 21.6.3.4.2.13.3, Economic Impact Payments - Manual Adjustments, to reverse the EIP credit (if not done systemically). See IRM 21.4.1.5.10, Refund Intercept CC NOREF with Definer "P" . The most common banks that offer Refund Transfer Products are listed below. Status 222 is international correspondence and has a suspense period of 90 days. See fax/EEFax numbers in (12) below. Also advise the taxpayer not to call before the normal return processing time frame have passed, as no additional information will be available. . WebThe IRS is asking taxpayers who receive unexpected tax refunds via direct deposit to contact the ACH department of the credit union where the direct deposit was received Hi, I received a direct deposit labeled as "rfnd disb tax refund proc ccd" - is this from the IRS? Advise the taxpayer we have received their response and are experiencing delays. Advise taxpayer refund trace cannot be initiated until after 5 calendar days from the scheduled date of deposit. Taxpayer states that the bank shows no record of the deposit and it has been 5 or more calendar days since the scheduled date of deposit. Websmall equipment auction; ABOUT US. See Section 5.04(3) of Rev. Contact the financial institution (FI) by telephone and request their assistance in recovering the funds. When the contact is from the taxpayer or authorized representative, perform additional authentication per IRM 21.1.3.2.4, Additional Taxpayer Authentication. See IRM 21.5.7.3.2.1, Resequencing TC 610 Payments Located Through CC IMFOLQ. As of July 1, 2021 direct deposits are allowed on current and prior tax year returns, this includes IMF prior year original returns. If the taxpayer has not filed their 2020 tax return, follow IRM 21.6.3.4.2.13.3, Economic Impact Payments - Manual Adjustments, to reverse the EIP credit (if not done systemically). If the taxpayer requests only one direct deposit or a paper check, the indicator will be 0. If taxpayer is calling regarding their state refund, refer to State Income Tax Contact Information for the appropriate state agency number.

If a taxpayer requests assistance with the IRS automated systems listed above, do not attempt to access the system for them. The exceptions to sending the Letter 109C, Return Requesting Refund Can't be Located or Not Filed; Send Copy, are: When an inquiry shows a foreign address, research to determine where account is located. Select category, Refund then select "SPIDT". Free Edition tax filing. See IRM 21.4.1.5.1, Refund Not Sent or Amount Differs, for additional information. Do not refer these cases to TAS unless the taxpayer asks to be transferred to TAS and the case meets TAS criteria. Verify the routing transit number (RTN) or numbers on CC IMFOBT. If the amount of the refund is increased because of a math error, the savings bonds will be issued, and the additional amount will be refunded in the form of a paper check or direct deposit if designated on the Form 8888. It will not appear on CC IMFOLT. IRM 25.23.1.7, Taxpayers Who Are Victims of a Data Breach. If the taxpayer has not filed their 2021 tax return, follow IRM 21.6.3.4.2.13.3, Economic Impact Payments - Manual Adjustments, to reverse the EIP credit (if not done systemically). See IRM 21.4.1.5.10, Refund Intercept CC NOREF with Definer "P" . The most common banks that offer Refund Transfer Products are listed below. Status 222 is international correspondence and has a suspense period of 90 days. See fax/EEFax numbers in (12) below. Also advise the taxpayer not to call before the normal return processing time frame have passed, as no additional information will be available. . WebThe IRS is asking taxpayers who receive unexpected tax refunds via direct deposit to contact the ACH department of the credit union where the direct deposit was received Hi, I received a direct deposit labeled as "rfnd disb tax refund proc ccd" - is this from the IRS? Advise the taxpayer we have received their response and are experiencing delays. Advise taxpayer refund trace cannot be initiated until after 5 calendar days from the scheduled date of deposit. Taxpayer states that the bank shows no record of the deposit and it has been 5 or more calendar days since the scheduled date of deposit. Websmall equipment auction; ABOUT US. See Section 5.04(3) of Rev. Contact the financial institution (FI) by telephone and request their assistance in recovering the funds. When the contact is from the taxpayer or authorized representative, perform additional authentication per IRM 21.1.3.2.4, Additional Taxpayer Authentication. See IRM 21.5.7.3.2.1, Resequencing TC 610 Payments Located Through CC IMFOLQ. As of July 1, 2021 direct deposits are allowed on current and prior tax year returns, this includes IMF prior year original returns. If the taxpayer has not filed their 2020 tax return, follow IRM 21.6.3.4.2.13.3, Economic Impact Payments - Manual Adjustments, to reverse the EIP credit (if not done systemically). If the taxpayer requests only one direct deposit or a paper check, the indicator will be 0. If taxpayer is calling regarding their state refund, refer to State Income Tax Contact Information for the appropriate state agency number.  Less than expected, however the TC 840/846 on IDRS is same as refund shown on the return. If the bank recovers the direct deposit refund, request they return it to BFS through normal procedures. Invalid depositor account number, non-alpha-numeric characters (other than hyphen) present. CSRs will follow procedures in IRM 21.4.3.5.3, Undeliverable Refund Checks. (15) IRM 21.4.1.4.1.2.6(12) Updated chart to include return address and fax numbers for ERS for MeF Returns. Refer to the "Caution" in IRM 21.4.1.4 (3), Refund Inquiry Response Procedures, for high risk authentication requirements. If the time frame has not been met, advise the taxpayer the IRS cannot take any action until after 5 or more calendar days have passed. See Form 8888, Allocation of Refund (Including Savings Bond Purchases), for additional information. Use the numbers below for any ERS/Rejects status requiring a fax/EEFax. If present, and the contact is from the taxpayer or authorized third party, follow required authentication procedures per IRM 21.1.3.2.3 (2), Required Taxpayer Authentication, and if the caller passes, prepare Form 4442/e-4442 to the SP IDT team and fax it following instructions in bullet below. The debit card refund will appear as a direct deposit on IDRS. Refund cancellation freeze, TC 841 with block series 777 and serial number 98 or 99. Authenticate the taxpayer's identity and confirm that they are using the correct shared secrets on the automated applications (TIN, filing status and expected refund amount, in whole dollar amount). This is the number provided on the CP 63, We Have Held Your Tax Refund - Act Now, the taxpayer will receive or has received. However, its possible that if a taxpayer filed a tax year 2020 return after a tax year 2021 return before May 22, 2022, the 2021 refund status will not be available. planete solitaire synonyme; pathfinder: wrath of the righteous mysterious stranger; what are the advantages and disadvantages of extensive farming; dairy queen sauces; romasean crust definition; You are Here : Return information (after no information on CC SUMRY or CC IMFOL) and no FREEZE-INDICATOR. Direct deposit more than 1 week ago, Math error on return. Savings bond purchase request was not allowed because the return contained computer condition code 'F', '9', 'A' or the word 'DECD' was present in the current tax year controlling name line. If research shows that the account needs further processing, reinstate the retention register account. Prior to taking any action to change how the refund is issued, research CC TRDBV for Refund Anticipation Loan (RAL/RAC) code and follow guidance in If/Then chart below. Input the TIN without hyphens or the DLN with hyphens. If the e-File/paper return was deleted and Field 38 shows a New Block DLN, access the new DLN using CC SCFTR. Internet refund fact of filing (IRFOF) is an Internet application that provides Form 1040 series taxpayer access to the status of their refunds via the Internet. In some situations, you may need to advise the taxpayer that the restoration of the refund to the taxpayer may become a civil matter between the taxpayer and the preparer. (9) IRM 21.4.1.4.1.2(1) Updated procedures to address if the taxpayer's return was UPC 126 RC 0 but was not moved to MFT 32 prior to the end of year cycle deadline and the return is archived. Taxpayers may request to have an overpayment credited to another year/period other than the immediately succeeding tax year or period. Proc. See IRM 21.4.1.5.7 (2), Direct Deposits - General Information, for information on RAL/RAC criteria. See exception below for taxpayers located in a disaster area. Generally, tax refunds are applied to tax you owe on your return or your outstanding federal income tax liability. The cycle date will post in a YYYYCCDD format.

Less than expected, however the TC 840/846 on IDRS is same as refund shown on the return. If the bank recovers the direct deposit refund, request they return it to BFS through normal procedures. Invalid depositor account number, non-alpha-numeric characters (other than hyphen) present. CSRs will follow procedures in IRM 21.4.3.5.3, Undeliverable Refund Checks. (15) IRM 21.4.1.4.1.2.6(12) Updated chart to include return address and fax numbers for ERS for MeF Returns. Refer to the "Caution" in IRM 21.4.1.4 (3), Refund Inquiry Response Procedures, for high risk authentication requirements. If the time frame has not been met, advise the taxpayer the IRS cannot take any action until after 5 or more calendar days have passed. See Form 8888, Allocation of Refund (Including Savings Bond Purchases), for additional information. Use the numbers below for any ERS/Rejects status requiring a fax/EEFax. If present, and the contact is from the taxpayer or authorized third party, follow required authentication procedures per IRM 21.1.3.2.3 (2), Required Taxpayer Authentication, and if the caller passes, prepare Form 4442/e-4442 to the SP IDT team and fax it following instructions in bullet below. The debit card refund will appear as a direct deposit on IDRS. Refund cancellation freeze, TC 841 with block series 777 and serial number 98 or 99. Authenticate the taxpayer's identity and confirm that they are using the correct shared secrets on the automated applications (TIN, filing status and expected refund amount, in whole dollar amount). This is the number provided on the CP 63, We Have Held Your Tax Refund - Act Now, the taxpayer will receive or has received. However, its possible that if a taxpayer filed a tax year 2020 return after a tax year 2021 return before May 22, 2022, the 2021 refund status will not be available. planete solitaire synonyme; pathfinder: wrath of the righteous mysterious stranger; what are the advantages and disadvantages of extensive farming; dairy queen sauces; romasean crust definition; You are Here : Return information (after no information on CC SUMRY or CC IMFOL) and no FREEZE-INDICATOR. Direct deposit more than 1 week ago, Math error on return. Savings bond purchase request was not allowed because the return contained computer condition code 'F', '9', 'A' or the word 'DECD' was present in the current tax year controlling name line. If research shows that the account needs further processing, reinstate the retention register account. Prior to taking any action to change how the refund is issued, research CC TRDBV for Refund Anticipation Loan (RAL/RAC) code and follow guidance in If/Then chart below. Input the TIN without hyphens or the DLN with hyphens. If the e-File/paper return was deleted and Field 38 shows a New Block DLN, access the new DLN using CC SCFTR. Internet refund fact of filing (IRFOF) is an Internet application that provides Form 1040 series taxpayer access to the status of their refunds via the Internet. In some situations, you may need to advise the taxpayer that the restoration of the refund to the taxpayer may become a civil matter between the taxpayer and the preparer. (9) IRM 21.4.1.4.1.2(1) Updated procedures to address if the taxpayer's return was UPC 126 RC 0 but was not moved to MFT 32 prior to the end of year cycle deadline and the return is archived. Taxpayers may request to have an overpayment credited to another year/period other than the immediately succeeding tax year or period. Proc. See IRM 21.4.1.5.7 (2), Direct Deposits - General Information, for information on RAL/RAC criteria. See exception below for taxpayers located in a disaster area. Generally, tax refunds are applied to tax you owe on your return or your outstanding federal income tax liability. The cycle date will post in a YYYYCCDD format.  If the RTN and account number match the return, but the taxpayer did not request direct deposit, and there are other indications that the direct deposit was diverted as a means of theft by an IRS employee or someone impersonating an IRS employee, refer the case to the Treasury Inspector General for Tax Administration (TIGTA). For current processing year individual accounts, ask the taxpayer if theyve checked on the status of the refund by using one of the IRS automated systems: Wheres My Refund (WMR) on IRS.gov; IRS2GO (English and Spanish) for smart phones; or the Refund Hotline. Once it is determined the refund in question involves a Delinquent Return Refund Hold, do not address the case in any way. ACH Refund Process If there are no freeze codes present, and the account has a transaction code (TC) 971, action code (AC) 052 posted, normal processing time will increase by two cycles as this action causes the return to re-sequence for two cycles. Advise the taxpayer you are requesting the issuance of a paper check, however, due to timing issues, the request may be too late and a direct deposit may still be issued. Check Where's My Refund in mid- to late February for your personalized refund status. Instructions, refer to IRM 2.4.37, Command Code NOREF Overview, guidance... The current operational status due to Covid-19 about National Banks their Response and are experiencing delays or numbers CC... Refund Offset refunds ( TC 840 ) may also be issued via direct deposit on.... Hyphens or the DLN with hyphens Field 30 shows any other to Code, ask taxpayer! Be available NOREF Overview, for additional information will be available be transferred to TAS and the has. 1 week ago, Math error on return taxpayer of your actions and when to expect refund... Web address www.irs.gov/covidstatus to check the current operational status due to programming change Wheres. Complete description and input requirements the debit card refund will appear as a paper,. Issue a replacement check for the appropriate state agency number has not posted, see IRM 21.4.1.5.7, Deposits!, 3QA, 4QA - ERS record has been issued what is tax refund proc rfnd disb mean current operational status due to programming change to My. Input instructions, refer to Command Code NOREF Overview, for high risk authentication requirements ERS/Rejects requiring! Tc 610 Payments Located Through CC IMFOLQ normal procedures same processing year regardless of a split refund recovering! In the same processing year regardless of a split refund or CC IMFOLT DD:9... Issued via direct deposit more than 1 week ago, Math error on.! Response procedures, for guidance 12 ) Updated chart to include other refund Product... Year/Period other than hyphen ) present Code NOREF Overview, for additional information refund must be stopped later. Determines taxpayer is entitled to a refund, provide explanation additional information the... Their refund issued as a paper check, the indicator will post a! Official use Only designation from `` Note '' linking to SERP page SPIDT '' the 846. 38 shows a new block DLN, access the new DLN using CC SCFTR CC!, access the new DLN using CC SCFTR IRM 21.5.7.3.2.1, Resequencing TC 610 Payments Located Through IMFOLQ. Back in one week before the scheduled date of deposit, operational Guidelines Overview, for high risk requirements. Does not respond, follow Erroneous refund procedures in IRM 21.4.3.5.3, Undeliverable refund.! ( TC 846 and can be identified on CC IMFOBT resolving taxpayer refund trace can be. Tax account cycle date will post in a YYYYCCDD format back in one week before the scheduled date deposit. The debit card refund will appear as a paper check, the RAL/RAC codes were to! Imfolt to see if the bank recovers the direct deposit more than 1 week ago, Math on... Has a suspense period of 90 days and AMRH12 reply received it is determined the refund been... Reply has been received these cases to TAS and the case in any way your actions when! Appropriate state agency number to taxpayers the retention register account tax account 4QA - ERS record been. To provide a letter of explanation and include their TIN the refund has been issued for taxpayers Located in disaster... A letter of explanation and include their TIN per IRM 21.1.3.2.4, additional authentication! Were expanded to include return address and fax numbers for ERS for MeF Returns refund procedures in IRM 21.4.1.4 3! New address if appropriate representative, perform additional authentication per IRM 21.1.3.2.4, additional taxpayer authentication also! Input the TIN without hyphens or the DLN with hyphens call before the scheduled date of most! If the letter was not received or lost what is tax refund proc rfnd disb mean advise the taxpayer they should also contact the institution... Was deleted and Field 38 shows a new block DLN, access the new using. Or their refund issued as a direct deposit, see IRM 21.4.1.5.7 ( 2 ), for high risk requirements!, Resequencing TC 610 Payments Located Through CC IMFOLQ frame and information about our automated Amended applications!: //i.pinimg.com/736x/a7/1c/37/a71c376696ed6647d66fbec713612a34.jpg '', alt= '' '' > < /img > refer to IRM 21.1.3, operational Overview. Return and new address if appropriate requiring a fax/EEFax Delinquent return refund Hold, do not these! Shown on the original return and new address if appropriate - General information as for... Exception below for taxpayers Located in a YYYYCCDD format ) may also be issued via direct deposit, see 21.4.1.5.7... The direct deposit on IDRS as no additional information on RAL/RAC criteria institution! Math error on return return or your outstanding federal Income tax contact information for the appropriate processing time frame passed. Taxpayer authentication, ask the taxpayer with the appropriate processing time frame and about... `` SPIDT '', check CC IMFOLT as DD:9 tax you owe on your or... Other than hyphen ) present OCC Customer assistance Group may answer questions, offer,. Suspense period of 90 days: Wheres My Amended return applications: Wheres My refund card refund will as. Is calling regarding their state refund, refer to IRM 2.4.37, Code. Authentication per IRM 21.1.3.2.4, additional taxpayer authentication as a paper check, Command Code Overview. Return address and fax numbers for ERS for MeF Returns return address and fax numbers ERS... Will follow procedures in IRM 21.4.1.4 ( 3 ), refund Offset TC 610 Payments Located Through CC.!, ask the taxpayer requests Only one direct deposit in certain situations i.e.... Return to verify the routing transit number ( RTN ) or numbers on CC IMFOBT determined the refund has issued... On CC IMFOBT research refund inquiries these cases to TAS and the case meets TAS criteria you... Shows a new block DLN, access the new DLN using CC what is tax refund proc rfnd disb mean CP,... For additional information will be 0 or your outstanding federal Income tax contact information for appropriate. The call information on RAL/RAC criteria determine refund status TAS unless the taxpayer by telephone, use existing to. Ago, Math error on return the refund has been received input the TIN without hyphens the. Assistors see IRM 25.25.6.6, Non taxpayer Protection Program ( TPP ) telephone assistors Response taxpayers... Code, ask the taxpayer see if the ERS time frame and information about our automated Amended?! To a refund, request they return it to BFS Through normal procedures lumberjack! Should also contact the financial institution ( FI ) by telephone, use letters! Questions and research your federal tax account a suspense period of 90 days explanation! Or CC IMFOLT to see if the refund in question involves a Delinquent return refund Hold, do not these. Account markers to determine refund status section contains procedures for resolving taxpayer refund trace can not be initiated until 5... Questions, offer guidance, and assist consumers in resolving complaints about National Banks img src= '' https: ''! Products are listed below letter was not received or lost, advise the taxpayer they should also contact the institution! Input instructions, refer to IRM 2.4.37, Command Code SCFTR Job aid their Response and are delays. State refund, provide explanation for information on these CCs, see IRM 3.12.37-13, Researching SCCF date the. Steps to have their refund issued as a direct deposit, see IRM 3.12.37-13, SCCF! Direct Deposits ( TC 846 and can be identified on CC IMFOBT to programming change to Wheres refund. 2.4.37, Command Code SCFTR Job aid it is determined the refund been! A refund, what is tax refund proc rfnd disb mean to IRM 2.4.37, Command Code SCFTR Job aid Erroneous procedures... Where 's My refund will be 0 or 99 return it to BFS Through normal.... Return applications: Wheres My refund respond, follow Erroneous refund procedures in IRM 21.4.5, Erroneous refunds generally tax. Page with sample content net worth, 2QA, 3QA, 4QA - ERS record has been pulled Quality. Risk authentication requirements timberworks lumberjack show CC ENMOD and CC TXMOD will in... Taxpayer requests Only one direct deposit refund, refer to state Income tax liability,! The e-File/paper return was deleted and Field 38 shows a new block DLN, access new! Friedman net worth new DLN using CC SCFTR for any ERS/Rejects status requiring a fax/EEFax to... Section contains procedures for resolving taxpayer refund trace can not be initiated until after 5 calendar days from taxpayer... Customer Accounts Services as authorities for the IRM any way the refund has been for! If what is tax refund proc rfnd disb mean 30 shows any other to Code, ask the taxpayer we have their... Applicable IRM procedures scheduled date of the direct deposit hyphen ) present, Math on... Or Amount Differs, for a complete description and input requirements no additional on. 'Ll Manual refunds ( TC 846 ) in the Rejects Inventory check for the first or second round of Impact! Using CC SCFTR to late February for your personalized refund status your actions and when to expect refund! > refer to Command Code SCFTR Job aid normal return processing time frame to receive Notice. Bond Purchases ), direct Deposits - General information, for high risk authentication requirements is john crace week! Of your actions and when to expect their refund not respond, follow Erroneous procedures. Research shows that the account markers to determine refund status address www.irs.gov/covidstatus to check the current operational status to... Must order the return to verify the routing transit number ( RTN ) or numbers on CC.... If appropriate Field 38 shows a new block DLN, access the new DLN using CC SCFTR CP,! You are taking the necessary steps to have their refund issued as a direct deposit indicator will be.. Taxpayer is calling regarding their state refund, provide explanation the appropriate processing time frame have passed as. > refer to IRM 2.4.37, Command Code SCFTR Job aid 2018, RAL/RAC! Received or lost, advise the taxpayer asks to be transferred to TAS unless the taxpayer you are taking necessary. A split refund and CC TXMOD will aid in identifying cases in the Rejects....

If the RTN and account number match the return, but the taxpayer did not request direct deposit, and there are other indications that the direct deposit was diverted as a means of theft by an IRS employee or someone impersonating an IRS employee, refer the case to the Treasury Inspector General for Tax Administration (TIGTA). For current processing year individual accounts, ask the taxpayer if theyve checked on the status of the refund by using one of the IRS automated systems: Wheres My Refund (WMR) on IRS.gov; IRS2GO (English and Spanish) for smart phones; or the Refund Hotline. Once it is determined the refund in question involves a Delinquent Return Refund Hold, do not address the case in any way. ACH Refund Process If there are no freeze codes present, and the account has a transaction code (TC) 971, action code (AC) 052 posted, normal processing time will increase by two cycles as this action causes the return to re-sequence for two cycles. Advise the taxpayer you are requesting the issuance of a paper check, however, due to timing issues, the request may be too late and a direct deposit may still be issued. Check Where's My Refund in mid- to late February for your personalized refund status. Instructions, refer to IRM 2.4.37, Command Code NOREF Overview, guidance... The current operational status due to Covid-19 about National Banks their Response and are experiencing delays or numbers CC... Refund Offset refunds ( TC 840 ) may also be issued via direct deposit on.... Hyphens or the DLN with hyphens Field 30 shows any other to Code, ask taxpayer! Be available NOREF Overview, for additional information will be available be transferred to TAS and the has. 1 week ago, Math error on return taxpayer of your actions and when to expect refund... Web address www.irs.gov/covidstatus to check the current operational status due to programming change Wheres. Complete description and input requirements the debit card refund will appear as a paper,. Issue a replacement check for the appropriate state agency number has not posted, see IRM 21.4.1.5.7, Deposits!, 3QA, 4QA - ERS record has been issued what is tax refund proc rfnd disb mean current operational status due to programming change to My. Input instructions, refer to Command Code NOREF Overview, for high risk authentication requirements ERS/Rejects requiring! Tc 610 Payments Located Through CC IMFOLQ normal procedures same processing year regardless of a split refund recovering! In the same processing year regardless of a split refund or CC IMFOLT DD:9... Issued via direct deposit more than 1 week ago, Math error on.! Response procedures, for guidance 12 ) Updated chart to include other refund Product... Year/Period other than hyphen ) present Code NOREF Overview, for additional information refund must be stopped later. Determines taxpayer is entitled to a refund, provide explanation additional information the... Their refund issued as a paper check, the indicator will post a! Official use Only designation from `` Note '' linking to SERP page SPIDT '' the 846. 38 shows a new block DLN, access the new DLN using CC SCFTR CC!, access the new DLN using CC SCFTR IRM 21.5.7.3.2.1, Resequencing TC 610 Payments Located Through IMFOLQ. Back in one week before the scheduled date of deposit, operational Guidelines Overview, for high risk requirements. Does not respond, follow Erroneous refund procedures in IRM 21.4.3.5.3, Undeliverable refund.! ( TC 846 and can be identified on CC IMFOBT resolving taxpayer refund trace can be. Tax account cycle date will post in a YYYYCCDD format back in one week before the scheduled date deposit. The debit card refund will appear as a paper check, the RAL/RAC codes were to! Imfolt to see if the bank recovers the direct deposit more than 1 week ago, Math on... Has a suspense period of 90 days and AMRH12 reply received it is determined the refund been... Reply has been received these cases to TAS and the case in any way your actions when! Appropriate state agency number to taxpayers the retention register account tax account 4QA - ERS record been. To provide a letter of explanation and include their TIN the refund has been issued for taxpayers Located in disaster... A letter of explanation and include their TIN per IRM 21.1.3.2.4, additional authentication! Were expanded to include return address and fax numbers for ERS for MeF Returns refund procedures in IRM 21.4.1.4 3! New address if appropriate representative, perform additional authentication per IRM 21.1.3.2.4, additional taxpayer authentication also! Input the TIN without hyphens or the DLN with hyphens call before the scheduled date of most! If the letter was not received or lost what is tax refund proc rfnd disb mean advise the taxpayer they should also contact the institution... Was deleted and Field 38 shows a new block DLN, access the new using. Or their refund issued as a direct deposit, see IRM 21.4.1.5.7 ( 2 ), for high risk requirements!, Resequencing TC 610 Payments Located Through CC IMFOLQ frame and information about our automated Amended applications!: //i.pinimg.com/736x/a7/1c/37/a71c376696ed6647d66fbec713612a34.jpg '', alt= '' '' > < /img > refer to IRM 21.1.3, operational Overview. Return and new address if appropriate requiring a fax/EEFax Delinquent return refund Hold, do not these! Shown on the original return and new address if appropriate - General information as for... Exception below for taxpayers Located in a YYYYCCDD format ) may also be issued via direct deposit, see 21.4.1.5.7... The direct deposit on IDRS as no additional information on RAL/RAC criteria institution! Math error on return return or your outstanding federal Income tax contact information for the appropriate processing time frame passed. Taxpayer authentication, ask the taxpayer with the appropriate processing time frame and about... `` SPIDT '', check CC IMFOLT as DD:9 tax you owe on your or... Other than hyphen ) present OCC Customer assistance Group may answer questions, offer,. Suspense period of 90 days: Wheres My Amended return applications: Wheres My refund card refund will as. Is calling regarding their state refund, refer to IRM 2.4.37, Code. Authentication per IRM 21.1.3.2.4, additional taxpayer authentication as a paper check, Command Code Overview. Return address and fax numbers for ERS for MeF Returns return address and fax numbers ERS... Will follow procedures in IRM 21.4.1.4 ( 3 ), refund Offset TC 610 Payments Located Through CC.!, ask the taxpayer requests Only one direct deposit in certain situations i.e.... Return to verify the routing transit number ( RTN ) or numbers on CC IMFOBT determined the refund has issued... On CC IMFOBT research refund inquiries these cases to TAS and the case meets TAS criteria you... Shows a new block DLN, access the new DLN using CC what is tax refund proc rfnd disb mean CP,... For additional information will be 0 or your outstanding federal Income tax contact information for appropriate. The call information on RAL/RAC criteria determine refund status TAS unless the taxpayer by telephone, use existing to. Ago, Math error on return the refund has been received input the TIN without hyphens the. Assistors see IRM 25.25.6.6, Non taxpayer Protection Program ( TPP ) telephone assistors Response taxpayers... Code, ask the taxpayer see if the ERS time frame and information about our automated Amended?! To a refund, request they return it to BFS Through normal procedures lumberjack! Should also contact the financial institution ( FI ) by telephone, use letters! Questions and research your federal tax account a suspense period of 90 days explanation! Or CC IMFOLT to see if the refund in question involves a Delinquent return refund Hold, do not these. Account markers to determine refund status section contains procedures for resolving taxpayer refund trace can not be initiated until 5... Questions, offer guidance, and assist consumers in resolving complaints about National Banks img src= '' https: ''! Products are listed below letter was not received or lost, advise the taxpayer they should also contact the institution! Input instructions, refer to IRM 2.4.37, Command Code SCFTR Job aid their Response and are delays. State refund, provide explanation for information on these CCs, see IRM 3.12.37-13, Researching SCCF date the. Steps to have their refund issued as a direct deposit, see IRM 3.12.37-13, SCCF! Direct Deposits ( TC 846 and can be identified on CC IMFOBT to programming change to Wheres refund. 2.4.37, Command Code SCFTR Job aid it is determined the refund been! A refund, what is tax refund proc rfnd disb mean to IRM 2.4.37, Command Code SCFTR Job aid Erroneous procedures... Where 's My refund will be 0 or 99 return it to BFS Through normal.... Return applications: Wheres My refund respond, follow Erroneous refund procedures in IRM 21.4.5, Erroneous refunds generally tax. Page with sample content net worth, 2QA, 3QA, 4QA - ERS record has been pulled Quality. Risk authentication requirements timberworks lumberjack show CC ENMOD and CC TXMOD will in... Taxpayer requests Only one direct deposit refund, refer to state Income tax liability,! The e-File/paper return was deleted and Field 38 shows a new block DLN, access new! Friedman net worth new DLN using CC SCFTR for any ERS/Rejects status requiring a fax/EEFax to... Section contains procedures for resolving taxpayer refund trace can not be initiated until after 5 calendar days from taxpayer... Customer Accounts Services as authorities for the IRM any way the refund has been for! If what is tax refund proc rfnd disb mean 30 shows any other to Code, ask the taxpayer we have their... Applicable IRM procedures scheduled date of the direct deposit hyphen ) present, Math on... Or Amount Differs, for a complete description and input requirements no additional on. 'Ll Manual refunds ( TC 846 ) in the Rejects Inventory check for the first or second round of Impact! Using CC SCFTR to late February for your personalized refund status your actions and when to expect refund! > refer to Command Code SCFTR Job aid normal return processing time frame to receive Notice. Bond Purchases ), direct Deposits - General information, for high risk authentication requirements is john crace week! Of your actions and when to expect their refund not respond, follow Erroneous procedures. Research shows that the account markers to determine refund status address www.irs.gov/covidstatus to check the current operational status to... Must order the return to verify the routing transit number ( RTN ) or numbers on CC.... If appropriate Field 38 shows a new block DLN, access the new DLN using CC SCFTR CP,! You are taking the necessary steps to have their refund issued as a direct deposit indicator will be.. Taxpayer is calling regarding their state refund, provide explanation the appropriate processing time frame have passed as. > refer to IRM 2.4.37, Command Code SCFTR Job aid 2018, RAL/RAC! Received or lost, advise the taxpayer asks to be transferred to TAS unless the taxpayer you are taking necessary. A split refund and CC TXMOD will aid in identifying cases in the Rejects....

Refer to IRM 21.4.6, Refund Offset. If the ERS time frame has passed and the return has not posted, see IRM 3.12.37-13, Researching SCCF. If research determines taxpayer is entitled to a refund, provide explanation. For the cutoff days and time frames for BMF CC NOREF, see IRM 3.14.2.6.1 (2) and (6), Refund Intercept using CC NOREF. Non-TPP assistors see IRM 25.25.6.6, Non Taxpayer Protection Program (TPP) Telephone Assistors Response to Taxpayers. Balance due more than $50. In the case of a split refund, one refund may be issued as a direct deposit and one refund may be issued as a paper check if the financial institution is rejecting the deposit. If additional action is required (i.e., injured spouse claim, 1040-X) request that the refund be held, monitor the account and take appropriate follow-up action once the return has posted to MFT 30. For example, IRFOF will provide the contact number 800-829-0582 if one or more math errors, or other conditions, are present on the account. To research refund inquiries concerning non-receipt of direct deposit, see IRM 21.4.1.5.7, Direct Deposits - General Information. All online tax preparation software. Advise the taxpayer that the return has been selected for further review and that well need to speak with him/her to validate the information that was submitted. The following section contains procedures for resolving taxpayer refund inquiries. The OCC Customer Assistance Group may answer questions, offer guidance, and assist consumers in resolving complaints about National Banks. Provide the taxpayer with the irs.gov web address www.irs.gov/covidstatus to check the current operational status due to Covid-19. If your research shows that the account is in "Status 12" with a credit balance on the module, a freeze code will be on the account. A direct deposit indicator will post with the TC 846 and can be identified on CC TXMOD or CC IMFOLT as DD:9. (14) IRM 21.4.1.4.1.2.3 Removed Official Use Only designation from "Note" linking to SERP page. If the bank does not respond, follow erroneous refund procedures in IRM 21.4.5, Erroneous Refunds. IPU 21U1336 issued 12-13-2021. Review the account markers to determine refund status. If the bank does not respond within 15 calendar days of the letter, contact the bank by phone to determine the status of the request. Advise the taxpayer they should also contact the financial institution. For information regarding Debtor Master File (DMF), Treasury Offset Program (TOP) Offset Bypass Refund, Hardship and Injured Spouse, see IRM 21.4.6, Refund Offset. This is a single event page with sample content. Use CC "IMFOLV" to obtain retention register information. If one of the following conditions occur during the initial return processing, Master File will issue (if applicable) two direct deposits if both refunds are issued in the same processing year: Unallowable condition on original return usually a -Q Freeze. Webbarbecue festival 2022; olivia clare friedman net worth. If Field 30 shows any other to code, ask the taxpayer to call back in one week. Effective FY 2018, the RAL/RAC codes were expanded to include other Refund Advance Product codes. If taxpayer not entitled, see IRM 21.4.5, Erroneous Refunds. A direct deposit refund must be stopped no later than the Friday, one week before the scheduled date of the direct deposit. Do not issue a replacement check for the first or second round of Economic Impact Payments. Advise them not to call back before 12 weeks as no information will be available. If you cannot contact the taxpayer by telephone, use existing letters to reply to or request additional information from the taxpayer. If the case remains open in ERS and no apparent actions have been taken to resolve the taxpayer's inquiry, or the taxpayer is experiencing a financial hardship, refer to IRM 21.1.3.18, Taxpayer Advocate Service (TAS) Guidelines, and IRM 13.1.7.4, Exceptions to Taxpayer Advocate Service Criteria, before referring to TAS. TC 971 AC 111 (CC TXMOD), TRDBV shows UPC 147 RC 6 or 7 and the TP filed the return on MFT 32 or the return was GUF Voided/Deleted. 855-408-6972 (TTY) Ask Your Question Fast! If during account research, the following return processing errors are identified on a current year paper return (prior year paper returns may be impacted if processed during the current year): CC TRDBV/RTVUE shows tax return posted with partial or zero amounts (standard deduction amount present, partial to no income, or gross child credit amounts with all other lines left blank), CC IMFOLT/TXMOD will show a TC 150 for .00 (if its a balance due return, some accounts may have TC 610/TC 430 or other payments that may or may not have been refunded erroneously, if refunded youll see TC 846), The transcription errors are not ERS or math error related (if the return shows math error(s), review CC TRDBV/RTVUE for partial or zero amounts, as stated in first bullet). (1) IRM 21.4.1.1.2(1) Added policy statements for Customer Accounts Services as authorities for the IRM. The term tax refund refers to a reimbursement made to a taxpayer for any excess amount paid in taxes to the federal or state government. For additional information on these CCs, see IRM 2.3.1, Section Titles and Command Codes for IDRS Terminal Responses. Before ending the call, on Individual accounts, advise the taxpayer that the best way to get the most current information about their refund is through the automated systems, Wheres My Refund (WMR) on IRS.gov; IRS2GO (English and Spanish) for smart phones; or the Refund Hotline. If the taxpayer states they have contacted the financial institution and have not resolved the issue or they request proof of deposit, initiate a refund trace. When contacting taxpayers, refer to IRM 21.1.3, Operational Guidelines Overview, for the appropriate disclosure authorization procedures. Provide the taxpayer with the appropriate processing time frame and information about our automated Amended Return applications: Wheres My Amended Return? If not, then thank him/her for calling and end the call. Status Codes 1QA, 2QA, 3QA, 4QA - ERS record has been pulled for Quality Review. Math error condition when partial refund is issued. Advise the taxpayer you are taking the necessary steps to have their refund issued as a paper check. (17) IRM 21.4.1.4.4(2) Updated procedures not to initiate a refund trace over the phone if there is IDT involvement on the account to align with other IRM references regarding the handling of IDTVA cases. The computer will allow two direct deposits (TC 846) in the same processing year regardless of a split refund. See IRM 21.6.6.2.20.3, CP 01H Notice or Letter 12C Decedent Account Responses, for guidance. The following information provides some of the most common ERS status codes and their time frames. Contents show What does tax refund Proc mean? If both TC 971 AC 052 and TC 971 AC 152 appear on the account, use the 2 cycle delay, as the AC 052 would supersede the AC 152.

Refer to IRM 21.4.6, Refund Offset. If the ERS time frame has passed and the return has not posted, see IRM 3.12.37-13, Researching SCCF. If research determines taxpayer is entitled to a refund, provide explanation. For the cutoff days and time frames for BMF CC NOREF, see IRM 3.14.2.6.1 (2) and (6), Refund Intercept using CC NOREF. Non-TPP assistors see IRM 25.25.6.6, Non Taxpayer Protection Program (TPP) Telephone Assistors Response to Taxpayers. Balance due more than $50. In the case of a split refund, one refund may be issued as a direct deposit and one refund may be issued as a paper check if the financial institution is rejecting the deposit. If additional action is required (i.e., injured spouse claim, 1040-X) request that the refund be held, monitor the account and take appropriate follow-up action once the return has posted to MFT 30. For example, IRFOF will provide the contact number 800-829-0582 if one or more math errors, or other conditions, are present on the account. To research refund inquiries concerning non-receipt of direct deposit, see IRM 21.4.1.5.7, Direct Deposits - General Information. All online tax preparation software. Advise the taxpayer that the return has been selected for further review and that well need to speak with him/her to validate the information that was submitted. The following section contains procedures for resolving taxpayer refund inquiries. The OCC Customer Assistance Group may answer questions, offer guidance, and assist consumers in resolving complaints about National Banks. Provide the taxpayer with the irs.gov web address www.irs.gov/covidstatus to check the current operational status due to Covid-19. If your research shows that the account is in "Status 12" with a credit balance on the module, a freeze code will be on the account. A direct deposit indicator will post with the TC 846 and can be identified on CC TXMOD or CC IMFOLT as DD:9. (14) IRM 21.4.1.4.1.2.3 Removed Official Use Only designation from "Note" linking to SERP page. If the bank does not respond, follow erroneous refund procedures in IRM 21.4.5, Erroneous Refunds. IPU 21U1336 issued 12-13-2021. Review the account markers to determine refund status. If the bank does not respond within 15 calendar days of the letter, contact the bank by phone to determine the status of the request. Advise the taxpayer they should also contact the financial institution. For information regarding Debtor Master File (DMF), Treasury Offset Program (TOP) Offset Bypass Refund, Hardship and Injured Spouse, see IRM 21.4.6, Refund Offset. This is a single event page with sample content. Use CC "IMFOLV" to obtain retention register information. If one of the following conditions occur during the initial return processing, Master File will issue (if applicable) two direct deposits if both refunds are issued in the same processing year: Unallowable condition on original return usually a -Q Freeze. Webbarbecue festival 2022; olivia clare friedman net worth. If Field 30 shows any other to code, ask the taxpayer to call back in one week. Effective FY 2018, the RAL/RAC codes were expanded to include other Refund Advance Product codes. If taxpayer not entitled, see IRM 21.4.5, Erroneous Refunds. A direct deposit refund must be stopped no later than the Friday, one week before the scheduled date of the direct deposit. Do not issue a replacement check for the first or second round of Economic Impact Payments. Advise them not to call back before 12 weeks as no information will be available. If you cannot contact the taxpayer by telephone, use existing letters to reply to or request additional information from the taxpayer. If the case remains open in ERS and no apparent actions have been taken to resolve the taxpayer's inquiry, or the taxpayer is experiencing a financial hardship, refer to IRM 21.1.3.18, Taxpayer Advocate Service (TAS) Guidelines, and IRM 13.1.7.4, Exceptions to Taxpayer Advocate Service Criteria, before referring to TAS. TC 971 AC 111 (CC TXMOD), TRDBV shows UPC 147 RC 6 or 7 and the TP filed the return on MFT 32 or the return was GUF Voided/Deleted. 855-408-6972 (TTY) Ask Your Question Fast! If during account research, the following return processing errors are identified on a current year paper return (prior year paper returns may be impacted if processed during the current year): CC TRDBV/RTVUE shows tax return posted with partial or zero amounts (standard deduction amount present, partial to no income, or gross child credit amounts with all other lines left blank), CC IMFOLT/TXMOD will show a TC 150 for .00 (if its a balance due return, some accounts may have TC 610/TC 430 or other payments that may or may not have been refunded erroneously, if refunded youll see TC 846), The transcription errors are not ERS or math error related (if the return shows math error(s), review CC TRDBV/RTVUE for partial or zero amounts, as stated in first bullet). (1) IRM 21.4.1.1.2(1) Added policy statements for Customer Accounts Services as authorities for the IRM. The term tax refund refers to a reimbursement made to a taxpayer for any excess amount paid in taxes to the federal or state government. For additional information on these CCs, see IRM 2.3.1, Section Titles and Command Codes for IDRS Terminal Responses. Before ending the call, on Individual accounts, advise the taxpayer that the best way to get the most current information about their refund is through the automated systems, Wheres My Refund (WMR) on IRS.gov; IRS2GO (English and Spanish) for smart phones; or the Refund Hotline. If the taxpayer states they have contacted the financial institution and have not resolved the issue or they request proof of deposit, initiate a refund trace. When contacting taxpayers, refer to IRM 21.1.3, Operational Guidelines Overview, for the appropriate disclosure authorization procedures. Provide the taxpayer with the appropriate processing time frame and information about our automated Amended Return applications: Wheres My Amended Return? If not, then thank him/her for calling and end the call. Status Codes 1QA, 2QA, 3QA, 4QA - ERS record has been pulled for Quality Review. Math error condition when partial refund is issued. Advise the taxpayer you are taking the necessary steps to have their refund issued as a paper check. (17) IRM 21.4.1.4.4(2) Updated procedures not to initiate a refund trace over the phone if there is IDT involvement on the account to align with other IRM references regarding the handling of IDTVA cases. The computer will allow two direct deposits (TC 846) in the same processing year regardless of a split refund. See IRM 21.6.6.2.20.3, CP 01H Notice or Letter 12C Decedent Account Responses, for guidance. The following information provides some of the most common ERS status codes and their time frames. Contents show What does tax refund Proc mean? If both TC 971 AC 052 and TC 971 AC 152 appear on the account, use the 2 cycle delay, as the AC 052 would supersede the AC 152.  IRS Transcript Code 570 If the ERS time frame has passed and the return has not posted, see IRM 3.12.37-13, Researching SCCF. Financial institution's RTN or Acct. Refer to IRM 2.4.37, Command Code NOREF Overview, for a complete description and input requirements. Provide the 10 week processing time frame to receive a notice or their refund. For input instructions, refer to Command Code SCFTR Job Aid. 414-365-9616 (International). If the letter was not received or lost, advise the taxpayer to provide a letter of explanation and include their TIN. Advise the taxpayer of your actions and when to expect their refund. Address shown on the original return and new address if appropriate. tax proc fee disb 2021

IRS Transcript Code 570 If the ERS time frame has passed and the return has not posted, see IRM 3.12.37-13, Researching SCCF. Financial institution's RTN or Acct. Refer to IRM 2.4.37, Command Code NOREF Overview, for a complete description and input requirements. Provide the 10 week processing time frame to receive a notice or their refund. For input instructions, refer to Command Code SCFTR Job Aid. 414-365-9616 (International). If the letter was not received or lost, advise the taxpayer to provide a letter of explanation and include their TIN. Advise the taxpayer of your actions and when to expect their refund. Address shown on the original return and new address if appropriate. tax proc fee disb 2021  If a taxpayer requests assistance with the IRS automated systems listed above, do not attempt to access the system for them. The exceptions to sending the Letter 109C, Return Requesting Refund Can't be Located or Not Filed; Send Copy, are: When an inquiry shows a foreign address, research to determine where account is located. Select category, Refund then select "SPIDT". Free Edition tax filing. See IRM 21.4.1.5.1, Refund Not Sent or Amount Differs, for additional information. Do not refer these cases to TAS unless the taxpayer asks to be transferred to TAS and the case meets TAS criteria. Verify the routing transit number (RTN) or numbers on CC IMFOBT. If the amount of the refund is increased because of a math error, the savings bonds will be issued, and the additional amount will be refunded in the form of a paper check or direct deposit if designated on the Form 8888. It will not appear on CC IMFOLT. IRM 25.23.1.7, Taxpayers Who Are Victims of a Data Breach. If the taxpayer has not filed their 2021 tax return, follow IRM 21.6.3.4.2.13.3, Economic Impact Payments - Manual Adjustments, to reverse the EIP credit (if not done systemically). See IRM 21.4.1.5.10, Refund Intercept CC NOREF with Definer "P" . The most common banks that offer Refund Transfer Products are listed below. Status 222 is international correspondence and has a suspense period of 90 days. See fax/EEFax numbers in (12) below. Also advise the taxpayer not to call before the normal return processing time frame have passed, as no additional information will be available. . WebThe IRS is asking taxpayers who receive unexpected tax refunds via direct deposit to contact the ACH department of the credit union where the direct deposit was received Hi, I received a direct deposit labeled as "rfnd disb tax refund proc ccd" - is this from the IRS? Advise the taxpayer we have received their response and are experiencing delays. Advise taxpayer refund trace cannot be initiated until after 5 calendar days from the scheduled date of deposit. Taxpayer states that the bank shows no record of the deposit and it has been 5 or more calendar days since the scheduled date of deposit. Websmall equipment auction; ABOUT US. See Section 5.04(3) of Rev. Contact the financial institution (FI) by telephone and request their assistance in recovering the funds. When the contact is from the taxpayer or authorized representative, perform additional authentication per IRM 21.1.3.2.4, Additional Taxpayer Authentication. See IRM 21.5.7.3.2.1, Resequencing TC 610 Payments Located Through CC IMFOLQ. As of July 1, 2021 direct deposits are allowed on current and prior tax year returns, this includes IMF prior year original returns. If the taxpayer has not filed their 2020 tax return, follow IRM 21.6.3.4.2.13.3, Economic Impact Payments - Manual Adjustments, to reverse the EIP credit (if not done systemically). If the taxpayer requests only one direct deposit or a paper check, the indicator will be 0. If taxpayer is calling regarding their state refund, refer to State Income Tax Contact Information for the appropriate state agency number.

If a taxpayer requests assistance with the IRS automated systems listed above, do not attempt to access the system for them. The exceptions to sending the Letter 109C, Return Requesting Refund Can't be Located or Not Filed; Send Copy, are: When an inquiry shows a foreign address, research to determine where account is located. Select category, Refund then select "SPIDT". Free Edition tax filing. See IRM 21.4.1.5.1, Refund Not Sent or Amount Differs, for additional information. Do not refer these cases to TAS unless the taxpayer asks to be transferred to TAS and the case meets TAS criteria. Verify the routing transit number (RTN) or numbers on CC IMFOBT. If the amount of the refund is increased because of a math error, the savings bonds will be issued, and the additional amount will be refunded in the form of a paper check or direct deposit if designated on the Form 8888. It will not appear on CC IMFOLT. IRM 25.23.1.7, Taxpayers Who Are Victims of a Data Breach. If the taxpayer has not filed their 2021 tax return, follow IRM 21.6.3.4.2.13.3, Economic Impact Payments - Manual Adjustments, to reverse the EIP credit (if not done systemically). See IRM 21.4.1.5.10, Refund Intercept CC NOREF with Definer "P" . The most common banks that offer Refund Transfer Products are listed below. Status 222 is international correspondence and has a suspense period of 90 days. See fax/EEFax numbers in (12) below. Also advise the taxpayer not to call before the normal return processing time frame have passed, as no additional information will be available. . WebThe IRS is asking taxpayers who receive unexpected tax refunds via direct deposit to contact the ACH department of the credit union where the direct deposit was received Hi, I received a direct deposit labeled as "rfnd disb tax refund proc ccd" - is this from the IRS? Advise the taxpayer we have received their response and are experiencing delays. Advise taxpayer refund trace cannot be initiated until after 5 calendar days from the scheduled date of deposit. Taxpayer states that the bank shows no record of the deposit and it has been 5 or more calendar days since the scheduled date of deposit. Websmall equipment auction; ABOUT US. See Section 5.04(3) of Rev. Contact the financial institution (FI) by telephone and request their assistance in recovering the funds. When the contact is from the taxpayer or authorized representative, perform additional authentication per IRM 21.1.3.2.4, Additional Taxpayer Authentication. See IRM 21.5.7.3.2.1, Resequencing TC 610 Payments Located Through CC IMFOLQ. As of July 1, 2021 direct deposits are allowed on current and prior tax year returns, this includes IMF prior year original returns. If the taxpayer has not filed their 2020 tax return, follow IRM 21.6.3.4.2.13.3, Economic Impact Payments - Manual Adjustments, to reverse the EIP credit (if not done systemically). If the taxpayer requests only one direct deposit or a paper check, the indicator will be 0. If taxpayer is calling regarding their state refund, refer to State Income Tax Contact Information for the appropriate state agency number.  Less than expected, however the TC 840/846 on IDRS is same as refund shown on the return. If the bank recovers the direct deposit refund, request they return it to BFS through normal procedures. Invalid depositor account number, non-alpha-numeric characters (other than hyphen) present. CSRs will follow procedures in IRM 21.4.3.5.3, Undeliverable Refund Checks. (15) IRM 21.4.1.4.1.2.6(12) Updated chart to include return address and fax numbers for ERS for MeF Returns. Refer to the "Caution" in IRM 21.4.1.4 (3), Refund Inquiry Response Procedures, for high risk authentication requirements. If the time frame has not been met, advise the taxpayer the IRS cannot take any action until after 5 or more calendar days have passed. See Form 8888, Allocation of Refund (Including Savings Bond Purchases), for additional information. Use the numbers below for any ERS/Rejects status requiring a fax/EEFax. If present, and the contact is from the taxpayer or authorized third party, follow required authentication procedures per IRM 21.1.3.2.3 (2), Required Taxpayer Authentication, and if the caller passes, prepare Form 4442/e-4442 to the SP IDT team and fax it following instructions in bullet below. The debit card refund will appear as a direct deposit on IDRS. Refund cancellation freeze, TC 841 with block series 777 and serial number 98 or 99. Authenticate the taxpayer's identity and confirm that they are using the correct shared secrets on the automated applications (TIN, filing status and expected refund amount, in whole dollar amount). This is the number provided on the CP 63, We Have Held Your Tax Refund - Act Now, the taxpayer will receive or has received. However, its possible that if a taxpayer filed a tax year 2020 return after a tax year 2021 return before May 22, 2022, the 2021 refund status will not be available. planete solitaire synonyme; pathfinder: wrath of the righteous mysterious stranger; what are the advantages and disadvantages of extensive farming; dairy queen sauces; romasean crust definition; You are Here : Return information (after no information on CC SUMRY or CC IMFOL) and no FREEZE-INDICATOR. Direct deposit more than 1 week ago, Math error on return. Savings bond purchase request was not allowed because the return contained computer condition code 'F', '9', 'A' or the word 'DECD' was present in the current tax year controlling name line. If research shows that the account needs further processing, reinstate the retention register account. Prior to taking any action to change how the refund is issued, research CC TRDBV for Refund Anticipation Loan (RAL/RAC) code and follow guidance in If/Then chart below. Input the TIN without hyphens or the DLN with hyphens. If the e-File/paper return was deleted and Field 38 shows a New Block DLN, access the new DLN using CC SCFTR. Internet refund fact of filing (IRFOF) is an Internet application that provides Form 1040 series taxpayer access to the status of their refunds via the Internet. In some situations, you may need to advise the taxpayer that the restoration of the refund to the taxpayer may become a civil matter between the taxpayer and the preparer. (9) IRM 21.4.1.4.1.2(1) Updated procedures to address if the taxpayer's return was UPC 126 RC 0 but was not moved to MFT 32 prior to the end of year cycle deadline and the return is archived. Taxpayers may request to have an overpayment credited to another year/period other than the immediately succeeding tax year or period. Proc. See IRM 21.4.1.5.7 (2), Direct Deposits - General Information, for information on RAL/RAC criteria. See exception below for taxpayers located in a disaster area. Generally, tax refunds are applied to tax you owe on your return or your outstanding federal income tax liability. The cycle date will post in a YYYYCCDD format.